Your cap table isn’t just a spreadsheet. It’s your company’s financial story and the first thing investors read!

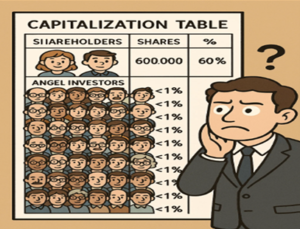

As investors, we have reviewed hundreds of pitch decks that looked great until we peeked under the hood and saw a crowded, chaotic capitalization table, commonly called a “cap table.” In several instances, we found that the ownership structure made future growth nearly impossible.

Let’s walk through why lean cap tables matter and how to build one that enables and not blocks the funding and scale.

What Is a Cap Table?

A cap table is a detailed record of who owns what in the company, from founders and investors to advisors, employees, and anyone holding any convertible instruments.

It typically includes:

- Shareholder names

- Types and number of shares owned

- Option pool allocations

- Convertible instruments

- Percentage ownership (pre- and post-funding)

This document becomes the foundation for every major conversation about control, dilution, payouts, and rights.

Why Does a Clean Cap Table Matter?

Provides Ownership Clarity

At Auxano, when we evaluate a startup, the first thing we see is who owns how much and what happens after dilution. A clean cap table shows whether founders still have meaningful skin in the game or if the equity is spread too thin. In one case we discovered the founders held less than 60% with no ESOP reserved and two more rounds to go. The math just didn’t work.

A good cap table clarifies:

- Ownership splits

- Rights and governance thresholds

- Exit and dilution scenarios

Why a lean cap table matters.

A well-structured cap table speeds up decisions and gives confidence in the startup’s ability to grow. Founders are at times reluctant to approach 50+ individual angels for pro rata consents or signatures.

Investors use the cap table to:

- Model future dilution and return outcomes

- Understand who holds control or blocking rights

- Negotiate fair entry based on existing structures

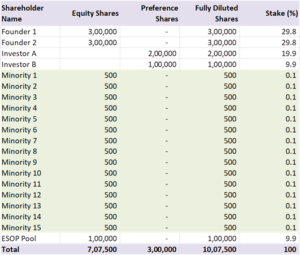

Table 1: Example for reference purpose only

Table 1: Example for reference purpose only

Tracks Value in Real Time

For both employees and investors, tracking ownership dynamically adds transparency and alignment. Auxano portfolio companies share quarterly cap table updates with all major shareholders, which makes future discussions smoother and well-informed.

Pre-Closing vs. Post-Closing Cap Table: What Investors Look For?

Pre-Closing Cap Table

This shows the current ownership – founders, angels, before the round closes. It’s our baseline to model how our investment dilutes others and ourselves.

Post-Closing (Fully Diluted) Cap Table

This reflects the final ownership, assuming all convertibles convert, and all options are exercised. It helps us understand our final stake, whether we meet minimum shareholding thresholds for rights (like information or board observer), and what headroom remains.

In one case, we ran simulations to assess how far we could let our stake dilute in future rounds and still retain key rights. Without a defined floor in the SHA, we discovered we could lose rights if we skipped even one round prompting us to renegotiate the terms upfront.

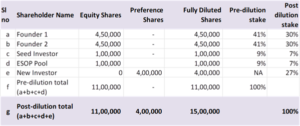

Table 2: Example for reference purpose only

Table 2: Example for reference purpose only

Why Can’t We Rely on Financial Statements Alone?

The financials, under the Companies Act, 2013, won’t capture the full ownership picture

That’s why we always ask for and scrutinize an internal cap table before moving forward.

Cap Table Mistakes That Kill Deals!

- Too Many Names, No Consolidation – We once reviewed a startup with 100+ angels, each with different terms. It turned a standard Series A into a legal circus.

Fix: Consolidate small cheques early using a nominee. One line on the cap table = one conversation.

Fix: Consolidate small cheques early using a nominee. One line on the cap table = one conversation.

- Veto Rights in the Wrong Hands – A 0.7% investor blocked an SHA amendment in one deal we reviewed, stalling the round. That single clause cost the founder four weeks of legal discussion, back-and-forth.Fix: Tie veto rights to meaningful thresholds or what the investor brings to the table besides capital.

- No Founder Vesting – There were cases where the departed co-founders still held 20% fully vested equity. That’s dead equity and a major red flag for institutional investors.

Fix: Apply 4-year vesting with a 1-year cliff to all co-founders and early team members.

- Rights Gridlock – If 25+ small shareholders all have rights, every funding round becomes a logistical headache. You must notify each of them, wait for decisions, and handle their paperwork. Some investors may be unresponsive, overseas, or disengaged, thus delaying your fundraise or forcing legal workarounds.

Fix: Restrict pro-rata rights to major shareholders or consolidate under a few investors.

To summarize, Cap Table Best Practices: How to Keep It Lean

- Consolidate small cheques

- Standardize templates

- Vesting for founders

- Reserve a 10–15% ESOP pool proactively

- Key rights tied to investors

- Update regularly

Final Thought

Treat your cap table like the guest list to an exclusive party. Only invite those who add value and won’t make it awkward when new guests (investors) arrive.

A clean, disciplined cap table tells us:

- You understand long-term value creation

- You respect your investors’ time and rights

- You’re ready to scale without tripping over your past

Founders who master their cap table stand out and for many investors, it is the first impression.

Author

Mansi Handa

Fix:

Fix: