A term sheet is a non-binding document that outlines the key terms and conditions of a potential investment or transaction. It is a letter of intent, serving as the basis for drafting final binding transaction documents like the SHA and SSA. Think of it as a fact sheet of rights and key points. However, a term sheet only summarizes the key commercial terms. SHA and SSA contain the detailed legal terms, mechanisms, obligations, and enforceability clauses. Without them, rights like exit, drag-along, tag-along, or warranties would have no binding legal force.

Thus, the reason SHA is still required, even after a detailed term sheet, is that it converts the agreed points into legally enforceable obligations, using precise legal terminology that courts and arbitrators recognize.

Like a rough sketch vis-à-vis a painting on canvas. Or like a blueprint/3D model of a building design.

One is legally enforceable; the other is not (except for confidentiality, costs, dispute resolution, and governing law). Nevertheless, a term sheet makes life easier, as it captures the intent clearly and sets the foundation for the detailed drafting that follows next.

Auxano’s experience

As the name suggests, the term sheet makes the intentions of both the parties clear and if the parties are not on the same page, then this is the point at which either party can walk away without investing further time and resources in drafting formal agreements.

In our experience, we have seen founders adhering to and honoring the term sheet at the time of drafting the transaction documents (SHA and SSA). Of course, there are a few exceptions, where the founder argues that since the term sheet is valid for a defined period, say 60 days, it no longer holds water. Here the negotiations get stalled and start afresh if the deal still makes sense.

So, if we have a detailed term sheet, then the investment journey is smooth hereon, right? Well, not necessarily.

- Due diligence may uncover facts that could affect the basis on which the terms had been agreed in the term sheet and now which might require to be revisited.

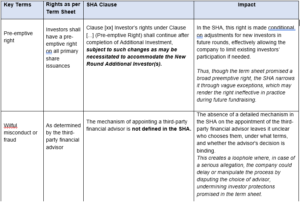

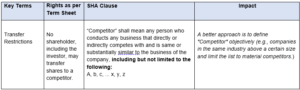

- Since the term sheet covers only key points in a short and crisp manner, the legal verbiage in the transaction documents could affect the interpretation in such a way that the terms get restricted or permitted with caveats.

Let’s take a top down view of some of the terms to understand this further:

Key Takeaways

The term sheet is the starting point, but the SHA and SSA are where the real legal detail, risk allocation, and enforceability come in. Together, they make sure everyone is on the same page and protected if things go south.

So, the term sheet is the headline -the key points that grab attention and tell you what the deal is about, in simple language.

While the SHA/SSA is the detailed article – all the facts, context, fine print, and scenarios, written in legal language so it stands up in court.

Author

Mansi Handa