Every day we screen scores of pitches from founders; some of them fit the investment thesis and we expect it to be a winner, but is it so? What looks inviting from the outside may not be as promising from the inside. Which is why we need to do thorough due diligence on the company and its founders.

What is Due Diligence (DD) Exactly?

The investor and founder agree on the investment transaction and sign the term sheet. Does the investment happen right away? The answer is no.

Due diligence is the determining factor whether the transaction would fall away or be consummated.

DD is a detailed analysis of the business & founders from a legal, financial, operational, and market perspective. The purpose is to ensure that the investment decision is a well-informed decision backed by solid data and not on whims, presumptions, or intuitions.

DD is not an Audit

One might wonder, is it not the same as an audit? After all, DD also verifies facts and assesses compliance and risk factors. However, DD is much more than that.

First of all, the purpose is different –

- DD is conducted to identify potential risk factors and critical details before an investment transaction to enable informed decision-making,

- Audit is done to comply with the statute for a particular period.

Since the purpose is different, hence the scope is different too.

An audit is limited to the review of financial statements, internal controls and comments upon the true and fair presentation of books of accounts of the company; however, DD is much more thorough, detailed, and comprehensive and may include operations, financial, & legal matters.

The DD exercise takes the audited financial statements as a base and a starting point but does not rely completely on the audit. For example, in some of the DDs undertaken by Auxano, we came across the following anomalies:

- The audited financials made no mention of inflow and outflow in foreign currency, whereas the bank statements showed a few receipts in US dollars. This discovery led to a further deep dive into compliance requirements under FEMA.

- The audited financials disclosed the related party details. However, upon cross verification with other relevant documents, it revealed that a particular director held majority shares in another entity. Thus, the company and this entity could be classified as “associate/related entities.” Further review of the ledger accounts of the company revealed that the latter had entered into several transactions with the associated entity during the year.

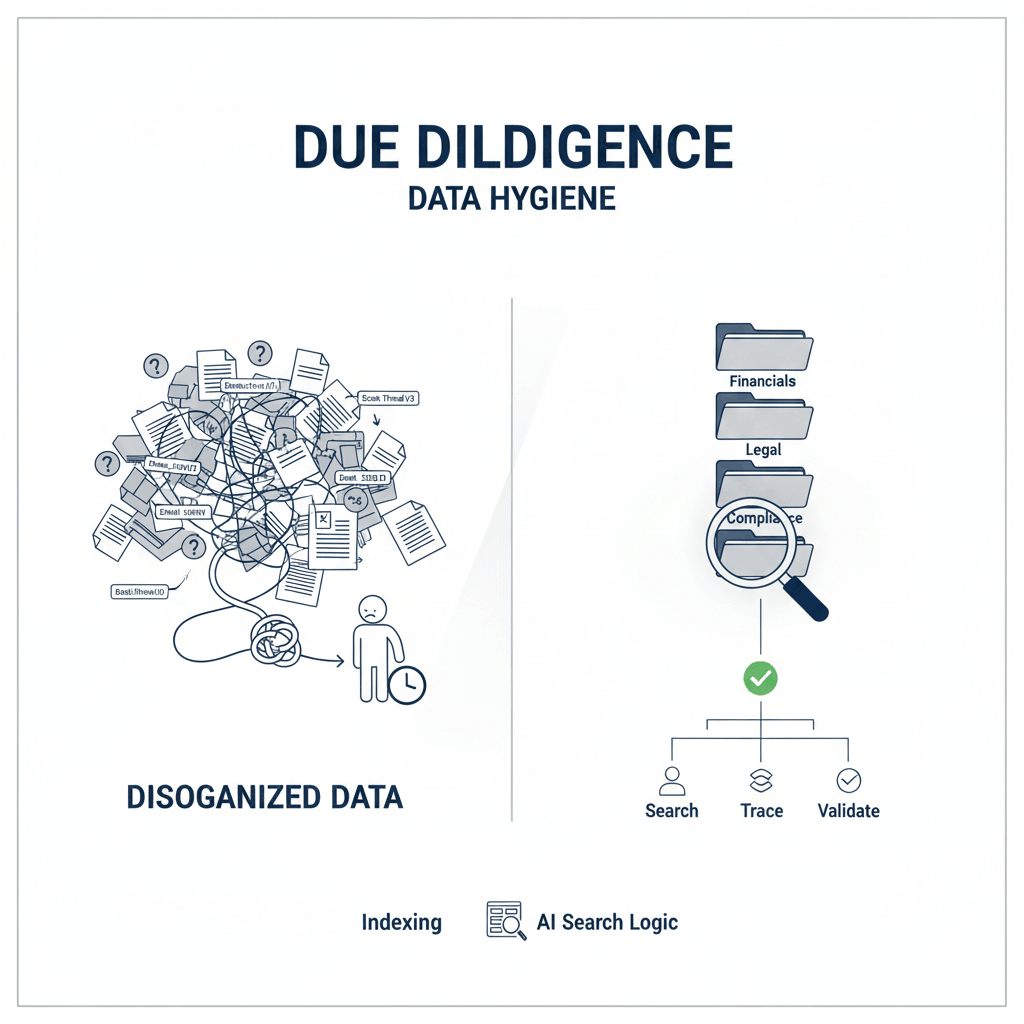

Scope of Due Diligence

As mentioned above, DD is a detailed exercise and encompasses a thorough verification of founder’s credentials and a thorough examination of financial and legal aspects of the business of the company. This is a detailed exercise and very time-consuming and involves a considerable cost.

Usually, before a term sheet is signed, the investor does a high-level due diligence, typically starting with the founder and the operations of the business.

This saves effort + time and identifies deal-breakers early on.

If the preliminary findings are satisfactory, one proceeds towards signing the term sheet. Thereafter begins a detailed due diligence of financial and legal matters of the company before concluding the transaction documents, provided the outcome is satisfactory.

Let us know a bit more about these aspects of due diligence.

Founder’s Due Diligence:

Herein, the following factors are considered

- founder’s credentials,

- background,

- pedigree,

- educational qualifications,

- work experience,

- interests in other ventures, etc. is verified from independent sources. In today’s day and age, this is fairly easy and convenient.

- Plethora of information is available on social media and publications.

- Reference from peer group and general impression from word of mouth is very useful.

- Participation by the founder at public forums give an insight into their thoughts and vision.

- Team management and leadership style.

- The stage of business gives an insight into alignment of vision with the execution and problem-solving skills.

- Information on business and company data bases such as Tracxn, Private Circle, MCA etc. contain valuable data.

For instance, from an independent review of other documents, Auxano was able to identify an ongoing legal dispute against a founder, which though a personal matter, had the potential to disrupt the business completely had he been convicted for the offence.

Similarly, in another case, DD revealed that a founder had multiple directorships in an executionary capacity in other entities, which gave us an insight into the extent of his involvement in the prospective investment opportunity that we were considering,

A business idea may be promising, but if the founder lacks focus, competence or the background does not check out, the business’s value diminishes, or it may fail entirely.

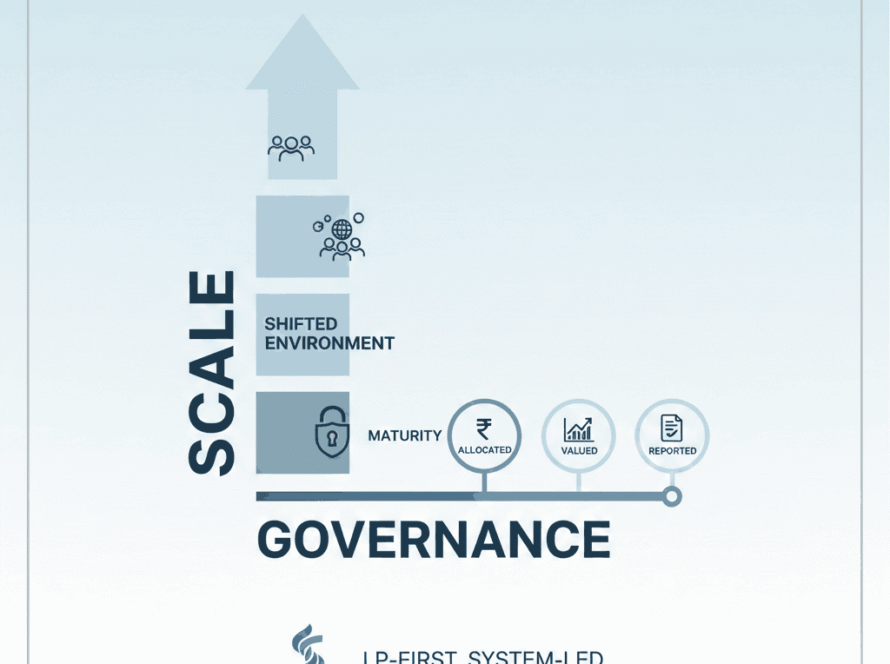

Operational Due Diligence

Operational due diligence is the other critical component and encompasses the following:

- Nature of the product; whether it solves a problem statement, is it a category creator, market creator or market leader?

- What is the business model of the company ?

- Are the operations cyclical or seasonal?

- What is the role of technology in the business operations, scalability and data integration?

- Is the team competent and well structured?

- What is the distribution and logistic strategy of the company?

- What is the overall profitability or cash burn of the company?

- How is the production or operational facility of the business?

- How does the business fare in the competitive landscape?

In another instance , upon understanding the documents in detail, it uncovered the fact that the flagship product of the company was in fact at a miniscule gross profit level, while the other non-core business and one-time services generated most of the revenue.

All of the above helps to determine whether the business is sustainable, profitable and scalable in the long run.

Financial Due Diligence (FDD)

As stated earlier, the FDD in particular, takes the audited financials as a starting point and dives deeper into the financial aspects, such as:

- Debt position of the company, any arrangement with banks, company’s liquidity position.

- Analysis of company’s debtors and receivables, credit risk, dependence on too few customers, review of major contracts.

- Working capital requirement of the company.

- Current and short-term liabilities.

- Analysis of revenue stream the revenue from core business operations, extraordinary income, spikes and dips in the revenue.

- Analysis of gross and net profitability, direct & indirect cost, fixed overheads, major expense heads.

- Compliance with tax laws and status of assessment and liability thereby.

- Depending upon the industry, whether it is capital intensive, relies on intangibles etc.

- Forecast of earnings and expense, capital expenditure of the company.

- Compliance with taxation laws

In one of the companies that we worked with, the company did not classify the expenses properly, thus deducting tax at source on all these expenses at a flat rate, which otherwise attracted a higher rate.

Legal Due Diligence (LDD)

It is essential to verify if the company is fully compliant with all the laws applicable to the business, such as Companies Act, labour laws, and the laws that may be specific to an industry such as insurance, banking, information technology, etc.

This involves a review of documents such as:

- Regulatory and secretarial filings

- Major contracts with customers and vendors

- Intellectual property, such as trademark, patents, proprietary software, copyright, licensing arrangements

- Financing arrangements

- Ongoing or potential lawsuits

- Terms of employment with key managerial personnel and the founder in particular non-compete , confidentiality

- Compliance with data protection and privacy laws

- Related party transactions

In one of the instances, it was found that the packaging of the product of a company was very similar to the packaging of another company in a related space. Upon this finding, the promoter promptly agreed to modify the same to avoid potential legal hassle.

Key Takeaway

The above process highlights potential red flags, bumps and blind turns along the way that require attention. Not all obstacles are a dealbreaker, some of the findings may even turn out to be milestones, making the journey smooth.

Due diligence should be like mining for a precious stone. We, chisel at the rock with effort and precision, and with each layer removed, we get closer to uncovering a unique and precious core.

The goal is to ensure that all the hard work reveals a genuine treasure, not just an ordinary stone.

The investor gets the comfort level to finalize a good deal or walk away from a washout deal.

The company, by sharing data and information not only inspires confidence in the investor but also cleans up the system and prepares for the next funding round win – win for all)

Author

Mansi Handa