In the late 1990s, RealNetworks was a pioneer in internet video streaming, capturing 85% of the streaming content market by the 2000s. Despite this early success, the venture ultimately failed commercially because the underlying infrastructure was not ready (average dial-up connection only reaching 56Kbps vs basic audio requiring 1.4Mbps), and constant buffering/bandwidth limitations made the user experience impractical.

During the same era, Blockbuster dominated the video rental market, controlling 40% of the US market share with over 9,000 stores by 2004. While the company experimented with streaming and Video-on-Demand (VOD) in the late 1990s, it abandoned these digital pursuits due to unviable technology and low adoption rates, choosing instead to prioritize its physical store model, however disruption was on the horizon.

A “Newcomer” first entered the market with DVD rentals in 1997 and then shifted to streaming in 2007, a decade later than RealNetworks and Blockbuster’s initial trials. This timing was crucial: broadband averages had improved and cloud infrastructure like AWS enabled scalability. By rejecting the incumbent buyout and waiting for market conditions to align, the company continued to scale (whilst competitors filed for bankruptcy in 2010) – reaching 300Mn+ subscribers in 2024, producing its own original content (Stranger Things, Squid Game, Sacred Games) and cementing its market position through acquisitions (including ongoing discussions to acquire a leading film studio).

Patterns Across Domains

History shows that ideas, products, and trends cycle through phases of emergence, dormancy, and resurgence across different aspects of civilization.

- Fashion & Retail: Indian fashion is experiencing the “Bollywood Y2K” revival—baggy jeans, crop tops, and oversized shirts returning as Gen Z staples. The distribution however has shifted from malls to Instagram thrift culture and resale platforms like Saritoria.

- Film & Music: From remixes of old hits and vinyl records which are seeing a resurgence in metros like Mumbai and Bengaluru (with sales growing over 6% annually), to even specialised devices like Saregama’s Carvaan (sold over 4.3 lakh units in FY25).

- Food & Beverages Agriculture Traditional Indian grains like Millets (Jowar, Bajra, Ragi) once side-lined as “ration shop food”, have returned as premium “Superfoods” via brands like Tata Soulfull and driven by the government initiatives like the “International Year of Millet” and growing exports (total domestic production rose to 180.15 lakh tonnes in FY25 of which 49% were exports).

These patterns suggest a fundamental tendency toward cyclical conformity (a mean reversion) – wherein society returns to where we started, but with a different context and improved technology.

Tech <> VC Lens

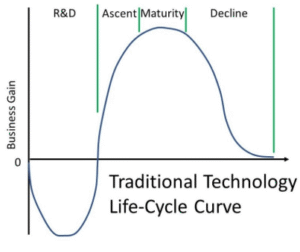

As we covered in a previous blog, Technological advancements also follow a predictable cycle:

- Emergence (R&D): A new technology emerges, often facing scepticism and resistance from established players.

- Early Adoption: Early adopters embrace the technology, paving the way for broader acceptance.

- Disruption (Ascent): The technology disrupts existing industries, challenging traditional business models.

- Maturation: The technology becomes mainstream, and its impact is fully realized.

- Decline: Existing technologies either get slightly updated (also-run case) or entirely replaced by newer products (decline case)

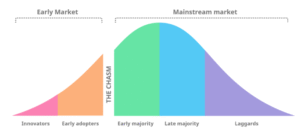

For investors, recognizing these patterns separates foresight from hindsight. Clayton Christensen’s work in The Innovator’s Dilemma explains why established companies often miss disruptive innovations. They optimize for existing customers and current profit margins, ignoring nascent technologies that initially serve smaller markets with lower returns. This creates opportunities for start-ups to build in emerging spaces before larger players recognize the shift.

- Cloud computing required ubiquitous broadband before becoming practical.

- Fintech needed digital payment infrastructure and regulatory frameworks.

- Food delivery apps needed smartphone penetration and gig worker participation to scale.

The ideas existed years before, but only scaled once these conditions aligned. Successful pattern recognition thus requires understanding not just what might work today, but when the conditions will support scalability – tracking technology adoption curves, regulatory developments, consumer behaviour shifts, and cost structures across sectors and over time.

Auxano Approach

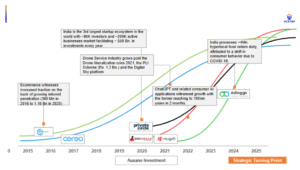

At Auxano, we have focused on identifying megatrends from inception, investing in spaces before they became consensus opportunities. Our early-stage investments in hyperlocal delivery, drone services and AI-enabled consumer applications positioned us at strategic turning points where technology, consumer behaviour, and business models converged.

However, timing remains the critical variable. We have seen in the past where companies have all the right ingredients – product, team, sizeable traction etc. but the overall ecosystem – be it regulatory, technological or customer preference does not sync and the business does not achieve meaningful scale.

We also encounter companies that return to us after initial fundraising attempts, either after closing successful rounds elsewhere or after struggling to raise capital. In these cases, we reassess based on what has changed:

- Has the founding team evolved?

- Has the market matured?

- Has unit economics improved?

- Has competitive positioning shifted?

Sometimes the answer is that the company was right but early. Other times, fundamental issues persist despite pivots. We have seen this pattern across industries

- One company in the waste management space that came to us during Seed round has shifted from a preliminary waste reuse and recycling operation to a high-margin energy extraction model.

- Another scaled an emergency response service successfully but identified limited profitability in their initial customer segment, leading to a pivot towards a higher-value segment.

These pivots demonstrate that pattern recognition applies not just to investment decisions but to operational strategy. Founders who recognize when their initial approach needs adjustment, based on market signals and timing, often find product-market fit in unexpected places.

Future(s) and Forward(s)

Understanding that things repeat over time provides a framework for evaluating opportunities in venture capital.

- Technologies that failed earlier may succeed now with different infrastructure.

- Business models that seemed impossible become viable as consumer behaviour evolves.

- Markets that appeared saturated reveal new opportunities through changed conditions.

Timing is therefore not about knowing with certainty. It is about understanding cycles, identifying inflection points, and maintaining conviction through the inevitable periods when market consensus suggests otherwise.

As for anyone trying to predict the future, just remember –

“Yesterday is history, tomorrow is a mystery, and today is a gift…that’s why they call it present”

Author

Aditya Golani