Introduction

A company secures funding from investors over a period of time in several rounds of financing. Each time the company raises funds in a new round, the total pool of the securities increases.

However, the earlier investors see the percentage of their ownership reduced. To that extent, every issuance made by a company is a dilutive issuance for the existing investors.

For this reason, the investors ensure that they have adequate safeguards in place in the shareholders’ agreement (SHA), such as Pre-emptive Rights and Anti-Dilution Rights.

However, both provisions are different in terms of scenarios in which they get triggered and the mechanism in which they work.

Pre-Emptive Rights

In the previous blog, we dove into the mechanisms of Pre-emptive Rights. We also discussed that when a Company issues additional securities, the investor holding a Pre-emptive Right is entitled (but not obligated) to maintain their proportionate or pro-rata ownership stake in the company on a fully diluted basis, if they wish to do so.

Down Round

In the subsequent rounds of funding, if the Company secures additional funds at a valuation that is lower than the valuation in the previous round, then this becomes a “Down Round” for the Company.

Thus, an earlier investor who had paid a subscription price higher than the current subscription price determined by the Company in the Down Round, the earlier investor stands to lose the value of its investment in the Company.

Therefore, in order to safeguard their interests, investors invariably negotiate Anti-Dilution Right which by its very name suggests a right that counters such dilution of their interests.

Here one might argue that both Pre-emptive Right and Anti-Dilution Right available to the investor entail issuance of shares and safeguarding the interest of the investor, thus both rights are similar.

However, both the rights work in different scenarios and involve different mechanisms to safeguard the rights of the Investor.

Pre-emptive Right allows the existing investor to participate in the new issuance of shares up to its pro-rata stake by buying additional securities in the Company and the Company secures additional funds from the existing investors.

By virtue of the Pre-emptive Right, the existing investor can equally participate in the Down Round too if it chooses, however, in this case the Company is still obligated to compensate the said investor for the loss in value of its earlier investment due to the Down Round.

Excluded or Exempted Issuance

Here, it is pertinent to note that the following issuances by the Company are typically excluded from the purview of dilutive issuance:

(a) Pursuant to the ESOP Scheme: The number of ESOP securities is determined by the Company and already considered and approved by the investor while drafting the SHA.

(b) Issuance of equity shares upon conversion of any duly issued convertible Securities: This kind of issuance is already considered and factored in the capitalization table of the Company.

(d) Issuance of any Securities in connection with bonus issuance, share split, capitalization of dividend or recapitalization by the Company and any anti-dilutive issuances itself to give effect to the valuation protection of the Investors.

How does Anti-Dilution work?

Let’s say that an investor had subscribed to compulsorily convertible preference shares (CCPS) of the Company. In a Down Round, an adjustment can be made to give effect to the anti-dilution provision in the following ways:

(i) One way is to adjust the conversion ratio of the securities held by the Investor, such that upon conversion of the CCPS, the Investor is issued such a number of equity shares as computed in accordance with the formula for Anti-Dilution.

(ii) The other way is to issue additional securities to the investor along with the new issuance of securities to a third party, without payment of any consideration by the Investor or payment of lowest permissible consideration as required under applicable law. The computation of the number of additional equity shares is again formula based.

As seen above, both achieve the same outcome either by adjusting the conversion ratio at the time of conversion or by issuing additional shares at the time of dilutive issuance without having to pay any additional amount. The basis for determining the adjustment of conversion ratio or number of additional shares to be issued is done by any of the following methods:

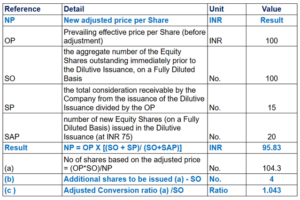

(i) Broad Based Weighted Average Anti-Dilution: This method works by taking into account a weighted average of the new shares issued and the prevailing price, computed as below:

NP = OP X [(SO + SP)/ (SO+SAP)]

Where:

NP = New adjusted price per Share

OP = Prevailing effective price per Share (before adjustment)

SO = The aggregate number of the Equity Shares outstanding immediately prior to the Dilutive Issuance, on a Fully Diluted Basis

SP = The total consideration receivable by the Company from the issuance of the Dilutive Issuance divided by the OP

SAP = Number of new Equity Shares (on a Fully Diluted Basis) issued in the Dilutive Issuance

Let’s understand the computation by way of a numerical example, where an existing investor holds 100 CCPS at a subscription price of INR 100, which implies that 100 CCPS would convert into 100 equity shares at conversion, i.e. at a ratio of 1:1

As seen in the example above, an investor could be issued 4 additional shares, or the conversion ratio could be adjusted to 1.043 to give effect to the anti-dilution provision.

This method is the most preferred method as it does not deter fresh investment from new investors while safeguarding the interests of the existing investors to an extent.

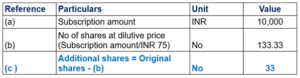

(ii) Full Ratchet Anti-Dilution: Unlike the weighted average method above, this approach does not consider the number of new securities issued, instead, it adjusts the conversion price of existing securities to match the price of the new securities.

Lets understand this using the numbers from the previous example:

While this approach provides a stronger protection to the Investor, but this can lead to significant dilution for the company and other investors who are not entitled to Anti-Dilution Right.

Besides, the company would appear less attractive to new investors since the anti-dilution provision only protects the current investors entitled to Anti-Dilution Right and places any burden of dilution on the new other stakeholders.

A Comparative Analysis

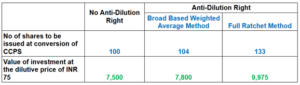

Based on the examples above, it is evident that the full ratchet method provides the maximum protection to the investors, while the broad based weighted average method provides protection to some extent. At the same time, without the anti-dilution provision, the investor’s investment value decreases significantly.

Summarizing below the outcome in the examples elucidated earlier:

Takeaway

Anti-dilution Right provides adequate safeguard to investors against significant erosion in value of their investments in case of a Down Round. Likewise, the Companies need to strike the right balance between creating opportunities for future funding while allowing the Investors to safeguard their investments.

Authors:

Mansi Handa, Karan Gupta