In our previous discussions, we covered critical clauses in a Shareholders’ Agreement (SHA), such as Information Rights, Pre-emptive Rights, and Anti-Dilution Rights. These clauses often spark extensive negotiations and can significantly impact a deal’s success or failure.

However, beyond these well-known provisions, SHAs contain several general clauses addressing operational and administrative aspects. These clauses are frequently overlooked and buried within legal jargon but can lead to significant issues if not properly structured and reviewed. Let’s explore some of these often-ignored clauses:

Use of Subscription Amount

Startups seek funding for various business objectives, including:

- Working capital requirements

- Research and development

- Marketing

- Business expansion

- Geographic expansion

- General corporate purpose

- Capital expenditure

Investors provide funding with a specific intent aligned with the startup’s business plan. Clearly defining the usage of funds in the SHA ensures transparency and prevents misuse.

⚠️ Risk: Funds meant for working capital were instead used to repay a director’s loan, causing breach of the agreement.

✅Best practice: Clearly outline fund allocation in the SHA, with periodic reporting to investors on fund utilization.

Timeline for consent

Investors must be adequately informed to exercise their rights effectively. For example, when a company issues new shares, pre-emptive rights holders are given a timeframe to accept or decline the offer.

⚠️ Risk: A company provides only seven days for right holders to respond, with just four working days, making it difficult for investors to act on time.

✅Best practice: Define business days according to the place of business and ensure a reasonable response time for investors, typically 14/21/30 business days, as may be relevant to the particular clause.

Notice Mechanism

To ensure that investors receive important updates and can make informed decisions, SHAs specify how notices should be delivered:

- Delivery by hand

- Courier or registered post

Any changes to contact details must be promptly communicated to all parties to prevent missed or delayed notifications.

⚠️ Risk: A notice was improperly sent, leading investors to claim they weren’t informed about amendments, invalidating the process.

✅Best practice: Define multiple modes of communication and require acknowledgment, such as email with read receipt, delivery acknowledged by the recipient.

Amendments to the Agreement

A new funding round often requires amending or restating the SHA. While investors seek to protect their rights, founders aim to avoid cumbersome approval processes for minor changes. The SHA should specify whether amendments require:

- Unanimous consent

- 66% majority approval

- 75% majority approval

- Consent from the lead investor only

- Consent only from shareholders whose rights are affected

Written consent signed by all required parties is crucial to ensure enforceability.

⚠️ Risk: A company with 100 shareholders required unanimous consent for a minor correction, causing unnecessary delays.

✅Best practice: Ensure different approval levels based on materiality of change.

Governing Law & Dispute Resolution

This clause determines which courts have jurisdiction in case of disputes and outlines the arbitration process, including the appointment of arbitrators and cost-sharing mechanisms.

⚠️ Risk: The SHA specifies Trivandrum courts for dispute resolution, while the investor is based in Delhi, leading to high logistics and litigation costs.

✅Best practice: The location of the party initiating the dispute could be the deciding factor for jurisdiction.

Independent Third-Party Appointments

Some SHAs mandate independent third-party assessments, such as fraud investigations, with costs borne by the company.

⚠️ Risk: A seed-stage startup specified a Big 4 firm for independent audits, imposing an excessive financial burden.

✅Best practice: An extensive list of professionals could be included in the definition, based on the size and stage of the company.

Survival Clause

A survival clause defines which obligations and rights remain enforceable even after the agreement ends. Key provisions that typically survive include:

- Confidentiality

- Term and Termination

- Notices

- Governing Law and Dispute Resolution

- Entire Agreement

- Severability

- Survival Clause itself

- Non-compete

⚠️ Risk: The agreement includes only a generic survival clause, leading to ambiguity about which provisions remain binding.

✅Best practice: Clearly define the duration till when the specific clause shall remain in force.

Key Takeaways 📝

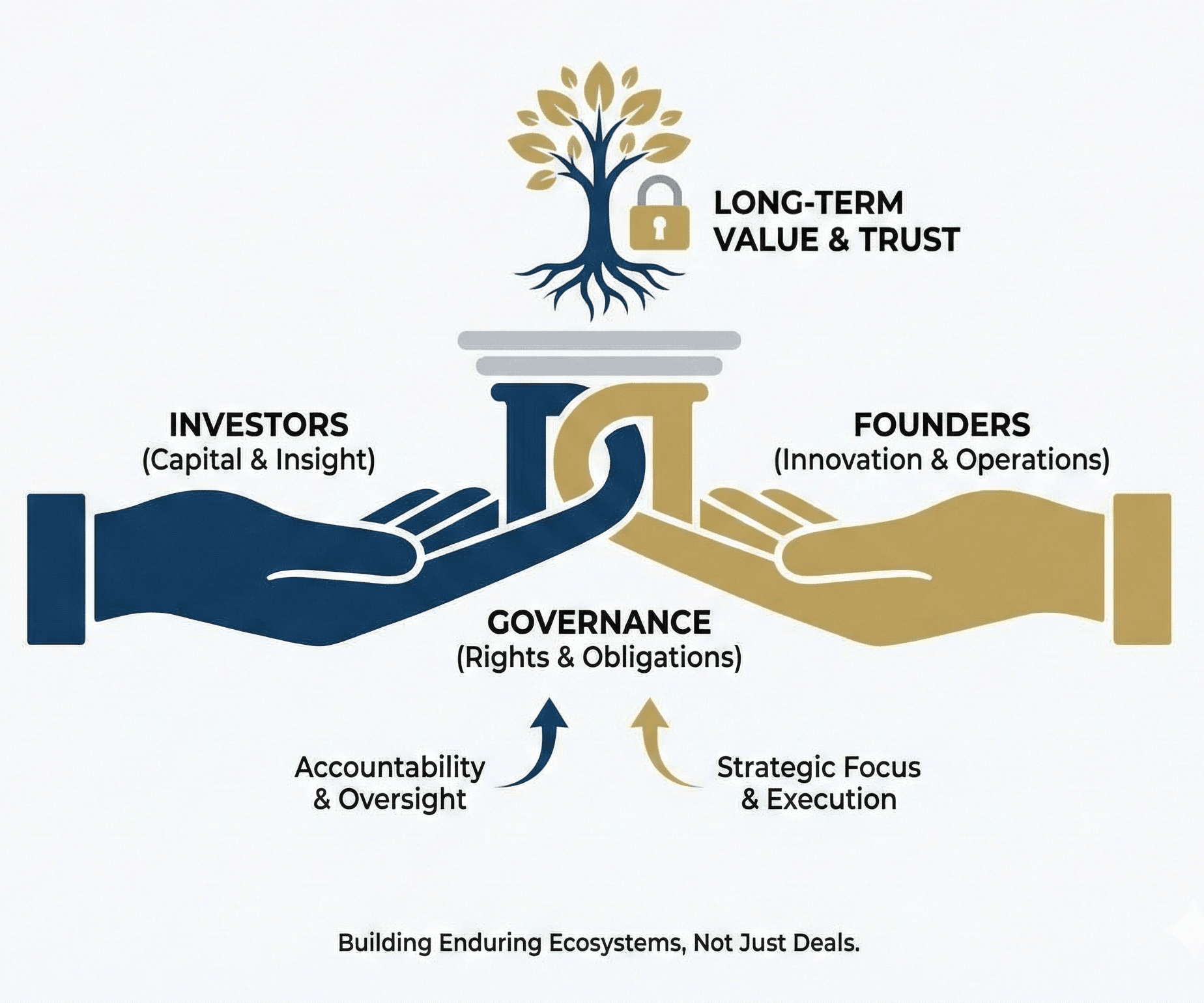

An SHA should be structured to eliminate ambiguities, operational delays, and legal disputes.

Misinterpretation or poor drafting of an SHA—whether intentional or unintentional—can result in unnecessary costs, funding delays, and erosion of trust. Regardless of the cause, a comprehensive review is essential to prevent unintended consequences. Founders must ensure that the SHA accurately reflects their intentions while avoiding vague or overly broad provisions that could lead to disputes or operational hurdles.

📌 Always plan for the worst-case scenario—these overlooked clauses become critical when things go wrong.

Author

Mansi Handa