Innovation is the ability to see change as an opportunity – not a threat. – Steve Jobs

Recently I was going through pitch decks of startups before they became unicorns, and I had few observations while going through those decks. Pitch decks

What intrigued me was how the businesses, products & technology used to look when it started and how they look now. And to follow up on that I wondered how they broke the competition and became market leader in their respective categories.

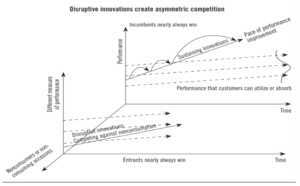

An illustration on disruptive technology theory by Clayton Christensen in his book “Disrupting class”, best explains this –

“It states that customers’ needs in a given market tend to be relatively stable over time. But technology tends to get better and faster than the needs of customers”.

Disruptive businesses are often rejected and looked at with skepticism on its first look. Because they either overshoot or undershoot the conventional thinking on whether its need is there or not.

(Figure 1 Source: “Disrupting class” – Clayton Christensen)

For eg: Airbnb was rejected by prominent silicon valley investors when it was raising $150,000 at a $1.5M valuation.That means for $150,000 they could have bought 10% of Airbnb. (Source)

So, how exactly does a disruptive business get a chance to become one?

Lets see an example based on the graph mentioned in figure 1.

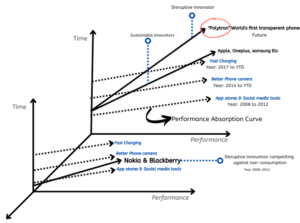

(Figure 2: Author’s own Ideation)

Let us look at these 2 graphs.

If we look at the fundamental innovations in cellular devices you will notice three main categories..

- App stores & social media tools

- Better phone camera

- Fast charging

Lower left graph indicates that Nokia and Blackberry were selling devices with features whose need relatively became stable over the period of time. Hence they were competing against non -consumption.

Upper right graph indicates that Apple, for example, started an app store in the year 2008 and followed by that quickly google also started android.

These choices turned out to be crucial for the entire smartphone ecosystem. As time went on, applications increased the smartphone’s functionality and produced amazing solutions to everyday problems.

There were no suitable distribution channels for developers to host their apps and make money, However, these app marketplaces provided them with a strong incentive to create solutions.

Nokia between the period of 2008 to 2012 continued its Symbian OS. But lack of incentives for the app developers due to less traction forced them to discontinue the OS in 2014.

On the other hand Blackberry tried to bring android in its BB10 OS in 2013. But it was too late!

Nokia again tried to disrupt the market by bringing Windows OS in phones in the year 2014. But lack of very popular apps like snapchat caused less traction and again their phones called “lumia” exited the market.

One important thing to look at is the timeline and the need-gap dynamics of the consumers. When apps came the internet penetration was still very less. However the apps runned on IOS and Android increased the usage.

Internet penetration started to increase rapidly and at the same time the younger population had the opportunity to access social media. This gave rise to the need for better cameras, which phone manufacturers brought in the phones.

Apps became heavier on OS & Increase in internet usage started to drain batteries. So phone manufacturers built batteries with larger capacity but even that was not enough so the “Fast charging” concept arrived in 2017 where you can charge the phone in less than 30 minutes.

What it tells us is that Apple, oneplus, samsung and other brands were constantly catering to the performance that consumers can absorb ( Figure 1 & 2) and at the same time phone manufacturers also brought features and upgrades which increased the performance absorption curve of the consumers.

So these are called “sustainable innovators” according to Christensen’s book.

Does that mean that any out of the box or innovative idea could become the next unicorn story?

The answer is no, what we have to look at is how this disruptive innovation is tapping into the large underserved consumers and their ability to increase consumer’s performance absorption curve going forward.

Something very similar on the same lines was told by one of our guests on Auxano Bytes podcast. Do listen it Here (2:54 Mins to 3:20 Mins)

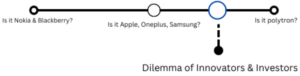

So, if you are evaluating or looking out for the next disruptor or an Innovator, one should look at the need-gap dynamics of the consumers which will give you an understanding of the performance absorption curve and can relate with the aforementioned example of cellular devices to anticipate is it disruptor like polytron? Is it a sustainable innovator like Apple, OnePlus, Samsung? Or is it fighting against non consumption like Nokia & Blackberry?

(Figure 3: Author’s own ideation)

To conclude, If I talk about Auxano’s categorization of the market then we have three pronged strategy to classify disruptive companies to cater to this performance absorption curve.

- Market owner

- Market creator

- Category creator

Founders and investors can see this categorization and sync it with the need-gap of the consumers to understand where exactly the pace of innovation falls in alignment with the ability of consumers to absorb the innovation.

Author:

Dr. Archit Shah