Why Vision Needs Validation

For VCs and ambitious founders, the discussion of Total Addressable Market (TAM) is often the highest hurdle in the pitch deck narrative. It tells the outer boundary of the story, the theoretical maximum revenue a solution could achieve. Yet, the presentation of this number frequently confuses potential opportunity with addressable viability.

Consider a story of the biologist and the ocean. If a biologist is studying a niche, specialized organism that can only survive in a specific, shallow saltwater bay, calculating the potential population size based on the volume of the entire global ocean is an exercise of no sense. The amount of the water is irrelevant if chemical and pressure constraints prevent survival outside the bay (I am an engineer). This confusion, mistaking the entire ecosystem for the viable population is the core flaw in most inflated market sizing exercises.

A historical case study illustrating this misstep is the Segway. Launched with enormous fanfare and signaled by its inventor as a machine that would do for walking what the calculator did for pad and pencil, the Segway was positioned for the massive market of short-distance urban commuting. However, the theoretical market never materialized into reality. Physical constraints coupled with a hefty $5K launch price meant that. But by 2007, Segway had captured a mere amount of its sales target. The existence of a problem (cars are inefficient for short city distances) does not guarantee a market if the product’s functional limitations create huge friction for adoption.

VC fund economics rely heavily on identifying companies capable of generating outsized returns, requiring markets large enough to support big exits. Therefore, market sizing is not merely an arithmetic exercise; it is the crucial initial step in mitigating the risk in an investment, ensuring the available terrain can truly absorb the required scale for success.

Top-Down Sizing

The most common framework used in pitch decks is the Top-Down approach, organized around the acronyms: TAM, SAM, and SOM. The Total Addressable Market (TAM) defines the 100% market share opportunity. The Serviceable Addressable Market (SAM) is the subset of TAM that the product can realistically serve given limitations like geography or technology. Finally, the Serviceable Obtainable Market (SOM) is the realistic market share capture in the near term.

The Aspiration

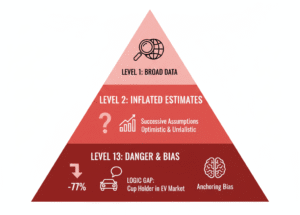

The Top-Down approach begins with broad macro-level data like

- Industry reports,

- Government statistics or analyst figures

and uses successive assumptions to narrow the scope.

This methodology is quick and provides a highly optimistic view of market potential. However, this optimism often leads to inflated estimates by projecting a broader customer base than the reality.

A typical pitch deck starts with the TAM slide, often claiming tens of billions, followed by the hopeful assertion of capturing the 1%” of that massive pie. This reliance on high-level Top-Down figures, disconnected from execution strategy, echoes the dangerous speculation seen during the dot-com bubble. That period saw valuations skyrocket based heavily on the promise of profitability rather than verifiable earnings, resulting in the the stock markets also plummeting from its peak.

For a VC, generic Top-Down numbers signal a lack of granular market understanding. Claiming the entire $900 billion electric vehicle market as TAM for a niche component like a specialty cup holder is perceived as illogical, revealing a fundamental misunderstanding.

Moreover, these initial projections can trigger anchoring bias. VCs, driven by the search for exponential returns, can place too much emphasis on a high initial TAM, anchoring their perception of the startup’s potential. This bias can lead to overinvestment in fading opportunities if investors continue to reinforce early, optimistic beliefs despite declining performance signals in later diligence. The relentless focus on maximizing TAM, therefore, serves as a psychological tool rather than a credible diligence output, often diverting founder attention away from defining the critical: minimum viable market.

Realistic Frameworks for Assessment

Bottom-Up Sizing

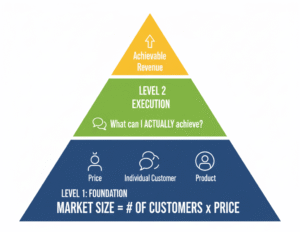

The Bottom-Up approach represents realistic market sizing. It starts with the product, the price, and the individual customer, scaling upward to define the achievable revenue. It answers the practical question: What can I actually achieve right now?

The Bottom-Up approach is intrinsically linked to execution: Market Size = Number of Customers paying for the product. This approach is practical because the underlying assumptions, customer definition, pricing, and go-to-market (GTM) strategy, are easily tested and validated. Furthermore, it highlights, for example, the absurdity of estimating 10K account captures with only five salespeople. The Bottom-Up calculation transforms market sizing from a theoretical estimate into an operational roadmap. If the calculated SOM is too small, the entity is immediately forced to either increase pricing or find a larger customer base, driving immediate product-market fit analysis.

Total Addressable Pain

For revolutionary products that create a new category or a market, using the size of the existing, old market serves as a misleading anchor. In these cases, VCs require frameworks rooted in value creation, often drawing conclusions from the MIS and cohort analysis data.

The most rigorous framework in this category is the Total Addressable Pain (TAP).

Let’s take an example of sizing the market for a B2B SaaS company:

- Define Target Units: Identify the specific number of companies/units experiencing the pain.

- Quantify Unit Pain Cost: Calculate the annual economic loss per unit (e.g., $5K lost productivity per employee).

- Calculate Total Pain: Determine the entire problem space (e.g., $5 billion annually)

- Model Value Capture: Estimate the percentage of this pain the product eliminates and subsequently, the percentage of that created value the startup captures as revenue (the 1%).

By framing the market size in terms of economic necessity, the startup founder can proactively mitigate investor skepticism regarding willingness-to-pay by the customer.

Example: Sizing the Pain for a Financial Risk Management SaaS

At Auxano, I recently evaluated a B2B SaaS company that provides a proactive data leak detection platform for financial institutions. Their initial pitch deck used a top-down market sizing approach, citing the global cybersecurity market size, which was valued at $193.73 billion in 2024 and is projected to grow to over $562 billion by 2032. While this shows a large, growing market, it doesn’t demonstrate the specific, quantifiable value of their solution. It’s the “whole ocean” problem again.

But when I looked at the solution which had a suite of over 7 products, each tailored for a specific problem, the market was realised to be a subset of the whole cybersecurity market. This exercise helps me understand the solution in a better manner.

- Each solution is tailored for a specific solution, so you first need to see how serious the problem is from the root. This involves reading reports, recent incidents and talking to industry experts.

- When I went deeper, I realized there could be an overlap between different problems and it needs a combination of 2 or maybe more solutions from this company. Now the question arises: Is there another player in the market who is doing this?

- The competition didn’t have a competitive product. This leads to the next question: Is it difficult to mimic this product?

- This whole exercise helps me understand how competitive the market is and how businesses are optimizing their chance of surviving in this competitive market.

- When trying to understand the market size, I try to link all the dots found in my research and connect in a way the founder would connect them. This way I get a good understanding of the company, and now I see the problem from the founders’ eyes.

Would this be always true? No.

The Pain and the Pie

As a VC analyst at Auxano Capital, good understanding of the market in a founder is ultimately a proxy for founder competence. The distinction between a compelling pitch deck and a successful investment lies in recognizing that market sizing is fundamentally a strategy tool. The exercise of rigorously sizing the market forces founders to refine their Ideal Customer Profile (ICP), validate their pricing, channelise marketing and chart realistic, phased expansion paths. This is what we did when evaluating an opportunity in the q-commerce space. As this space is growing and is expected to grow at a CAGR of more than 20%, here we saw the behaviour change the industry is creating from the ground up and realised the need for delivery orchestration service for the q-comm platforms.

A major portion of our portfolio companies have pivoted from their business model, but that doesn’t mean that we sized the market wrong or the founder overestimated the market size. The reason for pivots could be a combination of multiple factors or a single factor. In a big and growing market we at Auxano believe that there could be multiple players trying to make their share in the pie.

For VC standard returns, what matters is how much share of the pie the founder and company can capture rather than being a small player in a huge market.

The goal is not to find the largest possible number, but the most realistic one. The best founders size the problem first, ensuring their solution addresses a pain point so acute that the economic necessity justifies the product price. Only then do they proceed to build the pie of potential revenue. Ambition is necessary for venture scale, but conviction is earned through granularity.

Author,

Tanmay Gajbhiye