In venture capital, effective marketing isn’t just a ‘good to have’ it’s a ‘must have’ to stand out from the rest. At Auxano we look at strategic marketing to attract promising startups, build a distinguished brand, and create a network that drives value across our portfolio. Here’s our A-to-Z guide on tried and tested marketing strategies.

A = Audience Segmentation

We target founders, LPs, portfolio companies, and other investors through tailored content like our investing guides for potential investors and fundraising resources for founders.

B = Brand Positioning

As a sector-agnostic fund, we focus on Fintech, Sustainability, Industry 4.0, and Distribution Enablement, investing across stages (more details below)

C = Content (with a POV)

We balance educational pieces (SHA clauses, term sheet details) with unique perspectives (Star Wars and technology disruption, Mercator Projection and market sizing distortion, Venture investing and art).

D = Distribution

Our distribution channels including website, LinkedIn, newsletter, Twitter, YouTube, and Instagram showcase our approach, portfolio, and content including our books and Auxano Bytes podcast.

E = Ecosystem Engagement

Our flagship annual event – India Investment Ignition is based on this premise, bringing together industry leaders, entrepreneurs and investors to explore the emerging megatrends shaping the future of India. (Here’s a recap video for this year’s edition)

F = Founder Focus

Our portfolio companies and our founders are at the forefront of our content, in line with our philosophy of “Together we Ascend”

Inset: Founder Testimonials

G = Graphics & Visual Identity

All our collaterals and content pieces have a similar colour scheme of blue and orange, with our logo representing the journey of ascent (illustrated on the covers of all the Inside: Venture Capital books)

H = Helpful Resources

Our “Starting Up” blog series provides valuable guidance on brand building, deal-making complexities, and overcoming capital constraints, serving as helpful resources to founders (both first-time and seasoned alike)

I = Industry Expertise

We released our Esports Thesis, offering a comprehensive view of the growing e-sports industry with inputs from 40+ founders, investors, e-sports athletes and ecosystem experts.

J = Jargon Detox

Our core objective with every content piece is to avoid jargon and make it simple. As Einstein put it, “If you cannot put it in simple words that a 10 year old can understand, then you don’t know the subject well enough.”

K = KPIs That Matter

Beyond standard metrics (such as follower counts, engagement rates etc), we track indirect indicators of brand awareness, particularly valuable given SEBI restrictions on direct investor solicitation (as per SEBI AIF Regulations, 2012).

L = Long-Term Vision

Unlike companies chasing virality, we’ve maintained consistency since our inception with regular content across platforms (e.g. posting on Twitter since 2017, just 1 year after our inception)

M = Media Relations

At Auxano we actively collaborate with the press across platforms, providing expert insights where needed (here is a recent story on AI washing and our experience with AI first companies)

N = Newsletter

Since 2019, our weekly newsletter (now rebranded to “Ascent” – symbolizing the growth journey of startups) covers emerging megatrends and latest developments from the startup ecosystem. (You can subscribe to the same here)

O = Owned Assets

Tying up with the previous points, we prioritize channels we control, moving our blogs from third-party platforms like Medium to our website for better engagement

Inset: Recent Blogs

P = Portfolio Support

We actively keep track of our portfolio companies and engage with their content regularly, posting major updates through our channels for higher visibility.

Q = Quality over Quantity

We limit posts to 2-3 weekly on LinkedIn and 1-2 on Twitter, focusing on quality over quantity.

R = Relationship Building

Since inception, we’ve cultivated strong relationships, enabling us to provide portfolio companies with mentors, fundraising assistance, and compliance guidance.

S = Storytelling

As stated in the Content point, apart from blogs on the startup ecosystem, founder resources and governance we actively share blogs bridging unique concepts across history, science and art, showcasing our unique storytelling. Some of these are mentioned below

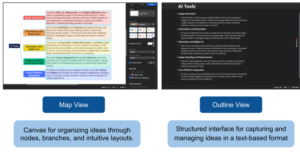

T = Technology Usage

We have covered the most common tech tools we use in our VC and Storytelling Series across three parts

- Writing: Claude, Perplexity, ChatGPT (provide ideas, research facts and improve structure)

- Illustration: XMind (for flowcharts, refer the image below) and Google Docs (for simple illustrations)

- Videography: Canva (video editing), Gimbal + Microphone (recording)

U = User Experience

From pitch forms to newsletter subscription pages, every external touchpoint matters. Much like our content, we have kept things simple by using Zoho (pitch forms, newsletter subscription and emailing, job boards) for all our tech needs.

V = Videography

Here’s a sneak peek behind our video creation process (you can check out our YouTube and Instagram for more such videos)

W = Website Optimisation

As mentioned in the Distribution point, we recently updated our website, bringing everything (from newsletters, blogs, job boards, our thesis and portfolio) under one single roof and optimising for efficiency with a 94 performance score as per Google Page Insights. You can check it out here

.

X = eXperiences (Live)

Building on the Ecosystem Engagement section, our annual event (India Investment Ignition) we feature a live experience section showcasing our portfolio companies (below are glimpses of the 2nd edition of III focusing on Interactive Technologies)

Y = Year Rewind

Here is the link to our 2024 Year in Rewind

Z = Zooming Out

While maintaining consistent posting, we regularly step back to recalibrate our strategy and prepare for timely updates about portfolio developments.

Takeaway

Effective marketing for VC firms isn’t about large campaigns or high budgets, it’s about authentically communicating our value, building meaningful relationships, and consistently delivering on your promises. At Auxano, we’ve found that the most successful marketing strategies are those that align with our investment thesis and firm values.

Author

Aditya Golani