In our interactions with prospects, clients & in general in the eco-system, many a times we come across individuals who want to be part of the venture investing.

With instances of success of InMobi, Flipkart, to name a few, in the past decade, the interest in venture investing is on the rise.

Data speaks.

With less than $10 Bn in AUM (Asset Under Management) by Indian VC firms till 2015, more than $35 Bn was invested in 2021 alone across all stages. In the 1st half of this decade, Zomato, Mamaearth, Ideaforge, Nyka, to name a few, have listed in the stock exchange

This is a positive for the eco-system.

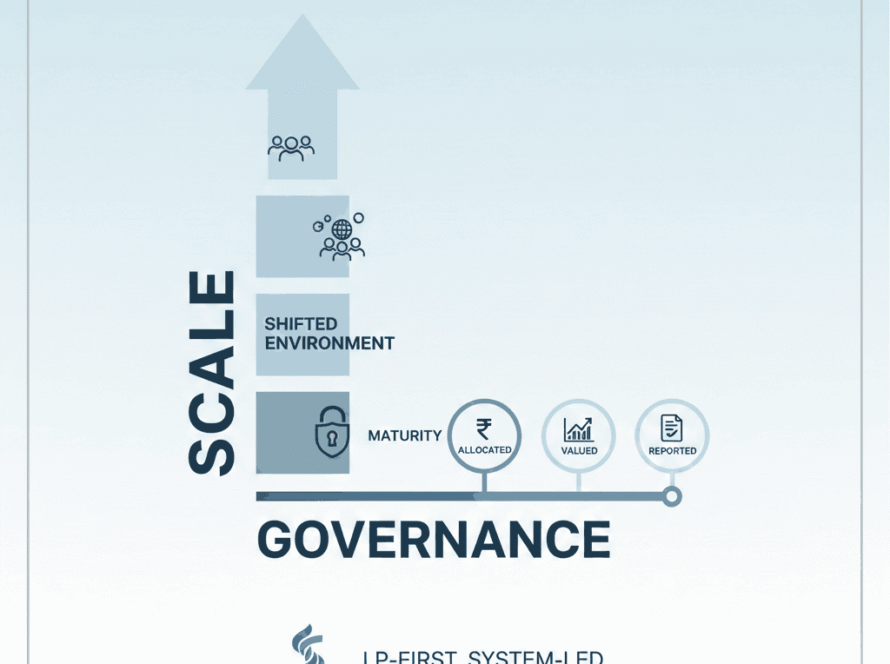

The regulator (SEBI) has also kept pace with this development. It would not be incorrect to say that India is the most regulated market in the venture space.

Now, we get queries from investors/prospects, wanting to invest in the early stage/ growth stage opportunities.?

Q. Should I invest?

A. Yes

Q. Are you sure?

A. No.

Q. Then, tell me why ‘Yes’ & ‘No’ also!

A. Lets dig deeper.

The percentage of failures in this space: more than success. What is celebrated are the successes.

Powerlaw is often quoted in this space.

Few investments generate outsized returns, majority yield little or zero.

Here’s an illustration:

Portfolio – 20 investments * Rs 1 Cr each

Outcomes

- 1 deal at 100x = Rs. 100 Cr.

- 2 deal at 10x = Rs. 20 Cr

- 3 deals at 2x = Rs. 6 Cr

- 4 deals at 1x = Rs. 4 Cr

- 10 deals at 0x = 0

Even 100x is an outlier. Can you live with this kind of outcome?

So, Yes – you should invest. If you cannot fathom this, then you should not invest.

Another important factor:

What is the time horizon for the investment? Not less than 5 years to begin with.

And if between 7-10 years, nothing like it.

Wealth is created in a longer time horizon – look at any of the names discussed in this note.

Nearly all of them took time to become the big ones they are. There will be pivots & we need to understand that early-stage investing is filled with these instances.

Having looked at all of the above, if you can fathom the volatility, uncertainty & timelines- come & join this ride.

Author,

Brijesh Damodaran