The term “going concern” in accounting refers to the assumption that a business will continue operating in the foreseeable future by utilising its resources and fulfilling its obligations without facing liquidation.

In the Venture Capital (VC) world, assessing a startup’s ability to function as a going concern is a critical aspect of the due diligence process, as typically early-stage start-ups entail high uncertainty, primarily due to

- limited financial history

- unique business models

- future projections are made with underlying assumptions rather than extensive historical data

- founder-driven nature, where success largely depends on execution and leadership

How VCs Assess Business Sustainability

Before investing, VCs evaluate several key factors to determine whether a startup has the potential to sustain and become profitable and continue as a going concern-

- Business Model Viability VCs examine the business model to understand:

- Scalability: whether the startup can grow efficiently.

- Sustainability: if operations can be maintained long-term, and

- Product Market Fit: how well the product or service fits the industry demand.

Assessing the value proposition, target market, and revenue model are all part of this. Startups often seen as Category Creators have the potential to unlock new markets through innovative offerings.

- Competition and Market Potential: Startups operating in developing markets with clear problem-solving needs can introduce new consumption patterns, positioning themselves as Market Creators with the potential to become Market Leaders.

- Financial Stability: VCs review financial statements and key metrics such as:

- Cost per Revenue (cost incurred to earn a single Rupee),

- Gross Margins ratio, and

- Burn rate (a high burn rate without revenue growth raises concerns about sustainability).

- Founders and Team: Founders’ experience and skills are crucial in determining the company’s long-term viability, generally assessed through

- Prior entrepreneurial or industry experience.

- Domain expertise, and

- Talent retention.

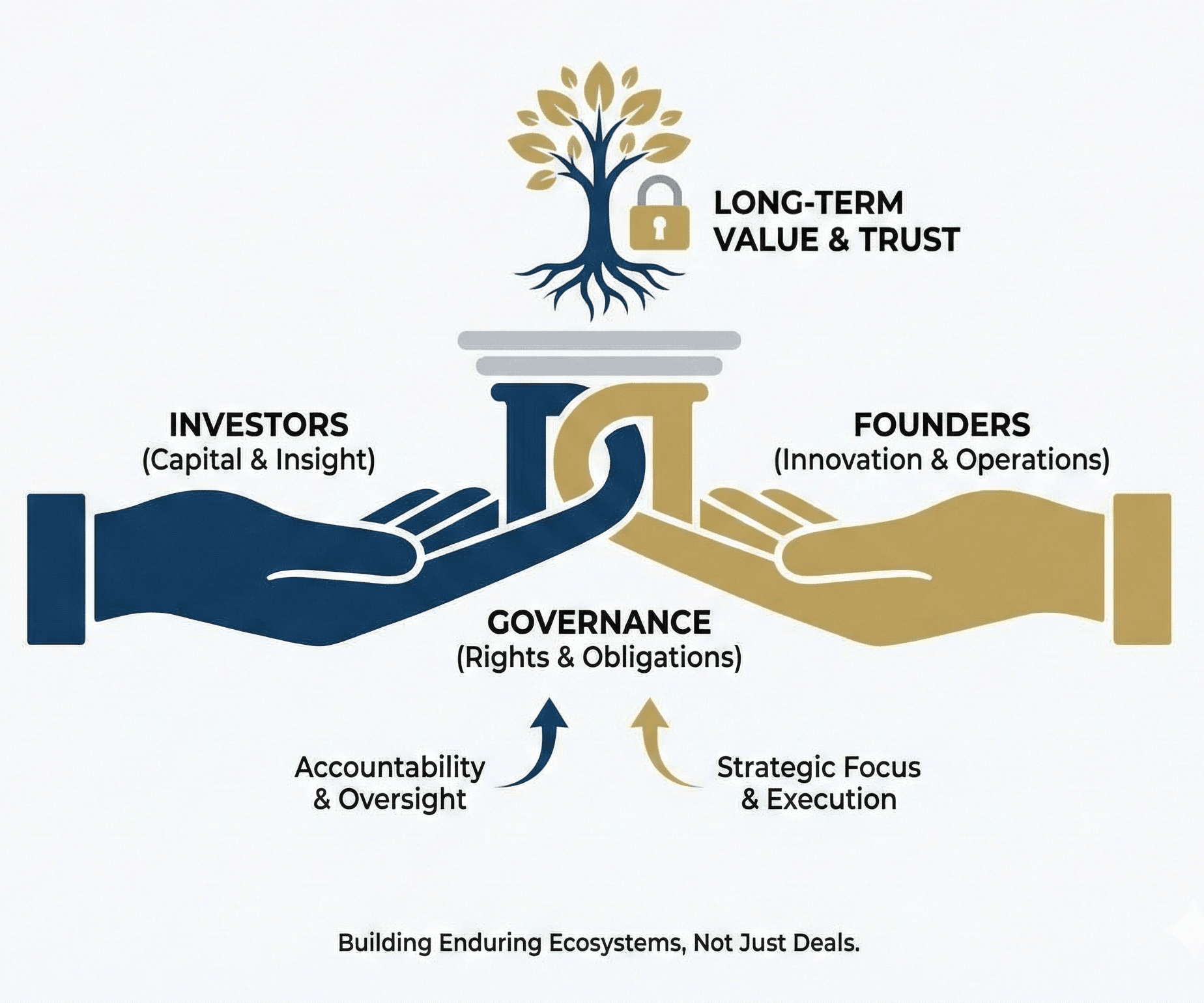

Investing is only the first step. Following an investment, continued involvement is necessary to monitor business progress and offer strategic assistance.

At Auxano, we follow the practice of having regular monthly and quarterly review calls with our portfolio companies to get business updates on key areas such as:

- Revenue and expenses for the month/quarter

- Cash & bank balance

- Hits & misses for the month/quarter

- Action plan for next month/quarter

- Support sought from Auxano

Additionally, few of operational metrics are part of review to track business efficiency and profitability

- Cash Runway: how long company can sustain to meet its expenses

- Customer Acquisition Cost (CAC): how much does the company spend on marketing to acquire a single new customer?

- Lifetime Value (LTV): how much does the business earn from a customer over their entire relationship

- Monthly burn rate: what is the amount of cash a company spends each month to cover expenses?

This structured approach safeguards the company’s financial and operational health, enabling informed decision-making.

Why Startups Fail Within 3-5 Years

Despite thorough analysis, many startups fail within a few years of their incorporation.

A report by CB Insights highlights some of the top reasons:

Financial mismanagement is the biggest reason behind failure. Cash flow is the lifeblood of any organization, but finances are frequently overlooked, which results in unsustainable operations.

Takeaway

Growth in revenue is important, but profitability is equally essential. In recent years, the startup ecosystem has shifted its focus toward profitability, ensuring long-term value creation for both founders and investors.

Thus, the term “ going concern” is more than an accounting concept – it is a critical lens through which VCs assess the risk and potential of their investments. While failures are inevitable in a high-risk, high-reward environment, lessons from past investments guide better decision-making for the future.

Author

Rakesh Rana