Gujarat International Finance Tec-City (GIFT City) is an ambitious project in India that is gaining interest from investors and businesses around the globe.

The broad vision behind setting up GIFT City is to bring India-centric business back to India, rather than losing it to other financial hubs like Singapore and London. It aims to create an internationally competitive financial hub that keeps jobs and economic activity within the country.

In our earlier blog post, we discussed the establishment of a fund in GIFT City and its key advantages.

Let’s dive into the key features of GIFT City, its challenges and recent developments that make it exciting…

What is GIFT City?

GIFT City is a unique multi-faceted project, broadly encompassing the following:

- A smart city with advanced infrastructure.

- A multi-service Special Economic Zone (SEZ), the first of its kind in India.

- An International Financial Services Centre (IFSC), a financial center in GIFT SEZ, operating as an offshore jurisdiction within India from Foreign Exchange Management Act (FEMA) perspective that provides financial services in any currency other than Indian rupee.

- The International Financial Services Centre Authority (IFSCA), a unified regulatory body, governing financial activities in IFSC.

Key Features of GIFT City –

- Unified Regulation: The IFSCA acts as a single regulator, consolidating the powers of the RBI, SEBI, IRDAI, and PFRDA, making regulatory processes more efficient.

- Diverse Participation: Small and medium-sized enterprises, investors, and financial services firms are among the many participants in GIFT City, which is not limited to big organizations.

- Ease of Capital Movement: With liberalized foreign exchange rules, Indian residents can now open foreign currency accounts (FCA) in dollars in GIFT IFSC bank accounts to make overseas portfolio investments.

- Investor Benefits: One of the advantages for non-resident investors in GIFT City, is that they are exempt from filing an Income Tax Return or obtaining a PAN in India.

Persisting Challenges –

While there are numerous advantages of setting up a fund in GIFT City, fund managers encounter certain challenges:

- Ensuring investor awareness about benefits to investing through GIFT city route, particularly NRI clients (who have an option to invest in Mainland Fund),

- Facilitating the initial operational setup (approval from two separate authorities – SEZ & IFSCA officials and separate monthly reporting)

- Despite exemptions from Goods and Services Tax (GST), businesses/funds are still required to get registered themselves and meet their monthly or quarterly compliance obligations.

- The principal officer and compliance officer must be physically located onsite within GIFT city, whereas the fund management activities may be conducted remotely.

- Onboarding investors from certain bordering countries has restrictions or is done through the government route, especially in cases where the funds are intended for investment in India (e.g. master-feeder fund structure).

- Setting up a fund in GIFT City typically takes around 9–12 months due to the dual authority registration and approval process that includes continued interaction with the authorities to be able to get a license. This includes:

-

- interacting with authorities

- addressing queries, and

- awaiting their responses

Once the license is granted, additional registrations with various authorities, such as GST, Import-Export Code (IEC), and Financial Intelligence Unit (FIU) are required to be in place.

However, recent developments in the regulations and efforts like government – led programs and events aim to address these issues to bring constructive changes.

Recent Developments in GIFT City

-

- IFSCA kickstarts the IFSCA (Informal Guidance) Scheme, 2024 – Standard Format for seeking Informal Guidance – which helps the funds in obtaining guidance and clarifications on regulatory matters.

- IFSCA through press release has relaxed the minimum corpus of scheme, from USD 5 Mn to USD 3 Mn

- Joint investments by 2 individuals in AIF Funds with specific relationships have been considered for non-retail schemes.

- For Portfolio Management Services (PMS), the minimum investment amount has been reduced to USD 75,000 from USD 150,000.

- In line with Budget 2024-25, IFSCA is establishing an International Arbitration Centre at GIFT IFSC to facilitate effective international law dispute resolution while promoting exports and ease of doing business.

- The Single Window IT System (SWIT) portal was launched by Hon’ble Prime Minister on September 16, 2024, to materialize the goal of a digital economy with the purpose of ease of doing business within IFSC.

Takeaway

GIFT City is not merely a static project; it is a dynamic ecosystem with enormous potential for future growth. As India progresses on its economic journey, GIFT City could emerge as a key global investment hub for businesses and investors.

Since its founding, GIFT IFSC has reached significant milestones such as recently granting the 200th fund license.

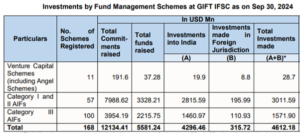

As of September 30th, 2024, official IFSCA data highlights the progress and growing importance of GIFT City as a global financial hub.

Sources: IFSCA

Auxano, an IFSCA-registered Category II fund, is proud to be a part of this journey.

Author

Rakesh Rana