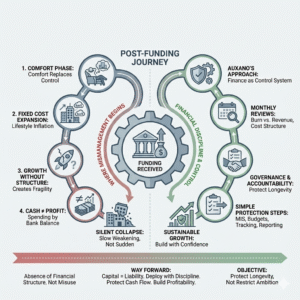

In almost every startup’s journey, there is a quiet change that happens after funding is received. The bank balance increases, plans become larger and hiring moves from ideas to salaries. During this phase, one important shift takes place — confidence starts replacing financial control.

Startup failures are often explained as market or competition problems. In reality, businesses rarely collapse suddenly. They weaken slowly when financial discipline reduces before ‘proper’ systems and controls are in place.

This gradual loss of financial control is the main reason behind most business failures. This is not about misuse of funds, it is about the absence of financial structure & process.

Let’s dive into – where financial mismanagement really begins and how it can be controlled.

Where Financial Mismanagement Really Begins-

Why even smart founders lose control, not because numbers are wrong but human behaviour around money…. behaviour changes before systems mature.

- The “Comfort Phase” – Where Control Starts to Slip

Financial mismanagement does not begin with losses. It begins when comfort replaces control..

After the first funding round, startups usually experience –

- a strong bank balance

- expansion comfort

- ‘relaxed’ cost discipline

This is where financial discipline starts weakening.

- Fixed Cost Expansion –

Just like personal lifestyle inflation, startups face cost inflation

- Larger office leases

- More SaaS tools

- Larger Sales Team etc.

Once fixed costs rise, flexibility reduces.

- Growth without Structure Creates Fragility

Funding brings speed. But speed without financial controls creates financial risk..

We have noticed businesses where revenue is growing, customer numbers are improving, and yet cash stress appears every quarter.

The reason is simple – Fixed costs become permanent, sales collections slow down and decisions start being made based on ‘comfort’ rather than control ?

- Cash is Not Profit

Funding also supports growth. It is not profit. Generally spending decisions are driven by bank balance rather than business value ??? This approach does create financial pressure silently. The company appears stable until it is not.

This is why funded startups still run out of money.

How We Look at Financial Discipline

At Auxano, finance is not treated as reporting. It is a control system (taking ownership and accountability)

From the first interaction with a founder, we look at:

- monthly cash runway

- burn versus revenue growth

- fixed and variable cost structure

- debtor collection discipline

- corporate governance, and more.

The objective is not to restrict ambition; it is to protect longevity. From the day of investment, we build a culture of monthly and quarterly business reviews with founders. These regular discussions help maintain financial clarity, support timely decisions, and create long-term value.

We believe that strong financial systems give founders the freedom to build with confidence..

Simple Steps That Protect Startups – These are not complex tools. They are basic habits to have the control over finance and business growth through –

- monthly MIS review

- clear budgets

- revenue-linked hiring

- tracking collections

- cost approvals

- timely reporting to investors

These steps do not slow growth. They protect it.

Way forward

Most of the startups fail within five years or even less. Founders often blame markets or competition, while financial mismanagement causes most of these failures.

There are numerous sources an organisation raise money, what’s important to know that all sources of funds in the balance sheet are liabilities, not free capital !

Capital needs to be deployed with discipline, follow the approved business plan, protect cash flow, and build profitability that can sustain the business and honour the trust of all stakeholders who support the journey.

Author,

Rakesh Rana