As a Chartered Accountant , during article ship, one of the areas to be covered was corporate compliance of the listed companies being audited — be it internal or statutory .

As Auxano entered into the Venture Capital ( VC ) space in 2016 , this was one of the primary considerations. And as Auxano formed its first AIF in 2019, it was clear that unless the promoters agreed to share data , the fund would not be inclined to invest .

We did face obstacles , as we were told that “Why are you seeking a detailed update?….No one asks this….We will share the metrics and that’s what will be shared”

The fund shared in the early stage of interaction with the promoters that the data on governance and MIS , will be required on a regular basis . This was to ensure that there was no communication gap on the expectation being set.

A leading luminary once said — “In God we trust , for the rest we have data”

And data with narrative is the key. As the early stage entity with the confident promoters ( we have stopped using the term — founders ) takes a leap of faith and moves forward , its important that the early believers in them are also kept in loop of the financial details and transparency .

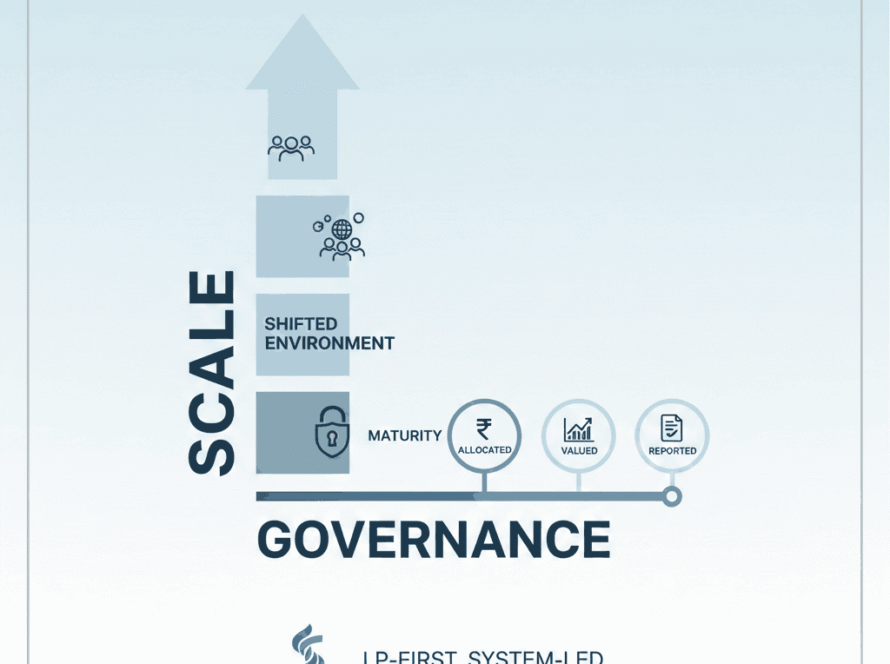

A VC does not run the business ( that is left to promoters and as and when buyout funds and PE’s invest into the entity) . VC’s provides early capital, supports the fundraise for the next level of growth and provides strategic and talent direction along with eco-system engagement.

Corporate Governance is to be considered in spirit and form. Spirit is as important as form.

With the Indian economy chugging along in a faster pace, the opportunities for new age companies and ideas will also grow exponentially . All the more important that Corporate Governance is not ignored and considered as a pain . It is an integral part of the institution building.

Recently, one leading luminary shared his experience on how following the corporate governance in both spirit and form, enabled his entity to get a premium valuation and also opening doors , as and when funds were being raised or being invested.

The corporate governance has to begin from the top , the promoter themselves. And that will set practice for the rest of the team members. The finance person should not be looked as a devil ( chuckles ) , but as a person who is an enabler .

As the GDP growth in India — the next trillion growth timelines gets shorter and the annual income grows at speed, lets embrace governance as part of growth .

Share more — is the approach . This will also enable capital to come in easier and faster.

More power to the promoters who are disrupting the status -quo and the believers who go along with them.

Author:

Brijesh Damodaran