“You got to ask the right questions.”

When it comes to understanding what really goes on behind the scenes, at a VC firm, the right answer to that is, anything and everything conceivable. On the outset, the hustle for the job seems smooth and endearing to an outsider, but once you actually get the opportunity to dive right into it, that is when the reality strikes you.

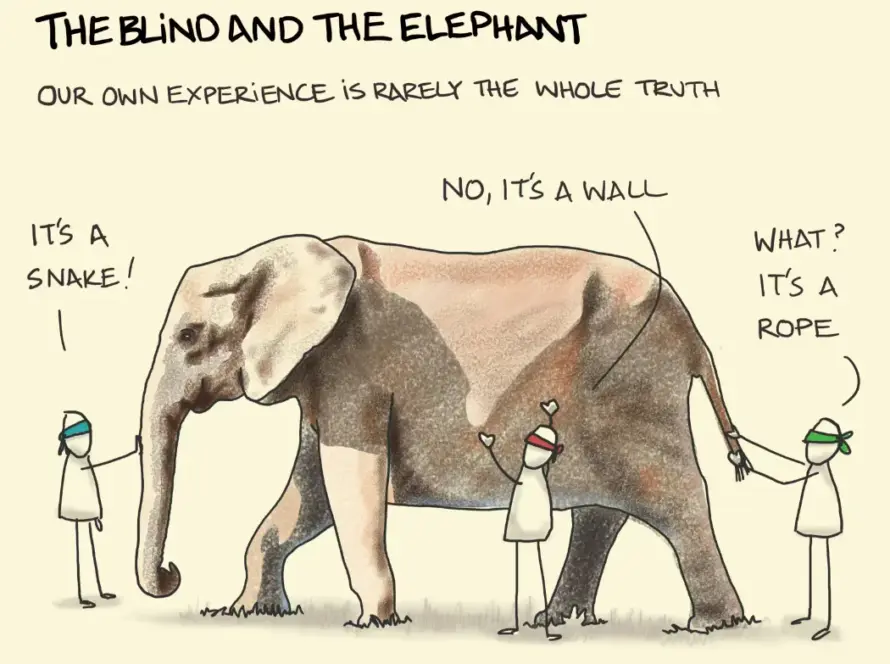

Coming from a research background, I came into the job, with my own preconceived notions and well formulated hypotheses regarding what I should expect. However, within a fortnight I have come to re-evaluate my testing hypotheses, as the questions have entirely changed.

Thus, within this space, I would enlist some essential questions that VC firms answered and what is the thought behind it.

“Why should a VC firm invest in your product or the concept of a product?”

There are only a set number of problems that grapple us. But how you see them, perceive them and aim to mitigate them, is what truly distinguishes you from the others. How will your product address a demonstrable market need or demand? If you can prove to your investor that your product is the most viable, cost effective and scalable solution to the problem statement, you’ve got your first foot in. The words to describe your product need not be fancy, as long as it best answers the problem you chose. It is important to demonstrate how your product will gain traction, and how it fits into the current market trends.

“What drives you to be where you are today?”

A founder’s passion is what the investors try to understand and assess. Through my first hand experience, I have had the pleasure to witness that exuberant joy a founder feels in describing his idea. It’s important to convey how your experience, your work ethic and your surroundings shaped you, to make you best equipped to cater to this specific need in the market. But does that mean only a “seasoned” founder can impress the board? Not necessarily. What you may lack in years, you can make up for, with a realistically achievable plan of action. If you can convince the investor of your execution skills, you have him listening.

“How do you perceive your competitors?”

A rookie mistake would be to claim a “first mover’s advantage” without having a realistic estimation of the competition in the market. A well informed leader makes the right calls, while an ignorant one might take rash decisions. When you give a representational view of the competitive landscape, and clearly define your positioning strategy, it gives the confidence to the investor that you have skills to combat competition. Moreover, healthy competition drives innovation within the market, and pushes a firm to be structurally ready to face challenges.

“How well can you assess the risks associated with your business?”

While existing competition in the market does come under risk assessment, but it is only one aspect of it. Other risks include government’s regulations and policies, labor market conditions, changes in business climate, cyber security, financial risks, technological shifts, etc. Evaluating these factors well before, will make you better prepared to offset these threats in the future.

“What is your extent of technology integration?”

For an investor it’s essential to understand your position on the extent of your technology integration. Explain to them how differentiated your technology is and what competitive advantages it has over its peers. State your key learnings during the prototyping phase or what additions you plan to make to your current offering. And most importantly, what are the costs associated with building your technological infrastructure. If you can justify your technology costs with effective results, it’s a leverage an investor is willing to grant you.

“When will your company achieve breakeven and generate profits?”

Numbers talk volumes. You can have all your ideas, thoughts and action plans in place, but without the correct numbers supporting them, it’s no good. Depending on what stage of product-life-cycle you are at, you need to portray your realistic projections for the future. Investors evaluate how rational your estimates are within the industry, how soon can you visualise your break-even point with those projections.

“What is a realistic valuation of your company?”

Valuations, I have come to realise how vague and yet so specific this term is. You are expected to put a number to the “worth” of your company. Value it too low, it may not seem as lucrative to an investor, and value it too high, it would be termed as unreasonable. The idea is to have clarity on your product, understand its potential given the current market trends, develop realistic estimates and projections, and most importantly assess the investor well before putting down a valuation number. Work on studying the investor, his financial capacities, industry specifics interests and risk taking capabilities, before finding a fit with them.

“What can possibly go wrong with your business?”

? “Be comfortable, being uncomfortable.” It’s not a bad thing to have challenges, uncertainties while working in the unknown. Investors do not look for companies wanting to play safe and not take risks.

? They want to assess how prepared you are to face the challenges head on. So the best way to deal with such queries is to enlist the possibilities of what could go wrong, but also define risk aversion strategies in place.

Be prepared to answer questions about company strategy, investments that should be considered, or new directions and paths to be taken. You should therefore do enough research to understand the corporation’s lines of business, current strategic direction, and challenges that it faces (now or in the near future).

Conclusion: The questions typically asked by a VC firm aren’t difficult. It’s the rationale behind it that needs to be assessed by a start up. Clarity on the expectations and requirements of a VC firm, can help start-ups in shaping their words in the most impactful way possible.

Convincing VC firms to fund your startup can be a difficult feat, as it’s not just the funds they are investing in you, but also their industry knowledge, resources, access to their huge network and their invaluable experience. As vulnerable investors, they want to be assured of best utilization of their funds with least amount of risks associated.

The idea is to guarantee them the maximum within the minimum. If they believe you could give them the best output with a well calculated input, you’ve assured them their money’s worth!