This is the second part of the series “cracking customer retention through Pre-Paid Instruments (PPIs)”. In this blog, we will decipher the dialect behind the recent developments in the PPI landscape.

In the last blog, we understood how D2C brands are adding value to their businesses by incorporating various forms of Pre-Paid Instruments into their ecosystems.

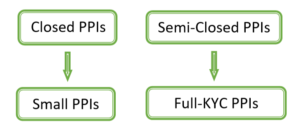

In accordance with the old RBI guidelines, we classified PPIs into:

- Open PPIs – Instruments that can be used to purchase goods and services anytime anywhere. For example, Paytm UPI.

- Semi-Closed PPIs – Instruments that can be used to purchase goods and services at limited identified establishments. For example, Amazon Pay, and Apple Pay.

- Closed PPIs – Instruments that can be used to purchase goods or services at respective establishments only. For example, DMRC travel card, and H&M reward wallet.

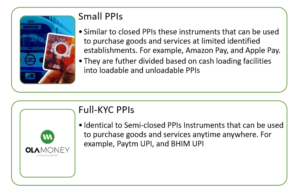

However, RBI has restructured the classification under the new Master Directions on Prepaid Payment Instruments (PPIs).

The new classification bifurcates PPI into Small and Full-KYC PPIs where Small PPIs are further bifurcated into loadable and unloadable PPIs.

The restructuring;

Small PPIs offer a cost-effective medium to evaluate the viability of incorporating PPIs into the ecosystem. However, both Small and Full-KYC PPIs are being equally adopted.

Companies like DMRC that favor convenience and have low average order values prefer Small over Full-KYC PPIs. Whereas Companies like Ola Money, who have larger order values and seek to expand the usable horizon of their instrument, prefer the Full-KYC instrument.

While the adoption of such instruments stands at the discretion of the brands, their execution is governed by a new set of regulations.

The new regulations bring forward the following key developments in the PPI landscape;

- Small PPIs

Similar to previous guidelines,

- Small PPIs can be issued with the minimum details of the receiver

- Such PPIs can be closed at the discretion of the receiver

However, major changes constitute as

- These PPIs need to be converted into Full-KYC PPIs within 24 months of their issue

- The amount withheld in this instrument should not surpass Rs. 10,000 from Rs. 5,000 previously, at any point in time

- The monthly limit for the instrument has been increased to Rs. 10,000 from Rs. 5,000 aggregating to Rs. 1,20,000 annually. This includes the amount outstanding and debited similar to the previous guideline

- Full-KYC PPIs

Similar to previous guidelines,

- Such PPIs can only be issued post fulfilling KYC requirements of the receiver

- The amount withheld in the instrument should not surpass Rs. 2,00,000 at any point in time

- Funds can be transferred between Full-KYC PPIs, with a transfer limit of Rs. 10,000

- Such PPIs can be closed at the discretion of the receiver

- Cash withdrawals are limited to Rs. 2,000 per transaction and Rs. 10,000 monthly

- There are no major developments in the case of Full-KYC PPIs

The current developments in the regulatory space of PPIs can be related to the events in the banking sector during 2007-09. The crisis called the attention of regulators to the lack of proper regulations governing lending and investing practices.

During the crisis, banks tried to push excessive credit to gain customers through NINJA loans (Issued to borrowers with no income). Identical to the intention, PPIs are being used to push credit through schemes and instruments like Buy Now Pay Later (BNPL), Interest-free EMIs, and No-KYC loans.

While such credit-lending practices through PPIs have enabled brands to incentivize customers to make purchases, customers are unaware that they are falling prey to loan traps.

In a classic example, Comparing a lumpsum purchase of Rs. 10,000 vs an EMI @12% simple interest on the same amount for 5 years, highlights that we end up paying approximately 60% (Rs. 6000) more for the product or service.

EMIs give an incentive to the customers to default on the obligation to save money in case they don’t like the product. Left unrestricted, this can turn into a common practice like in 2007-09, leading to large numbers of defaults.

Moreover, the accumulation of such defaults can be catastrophic as their origin is difficult to trace due to a large number of companies extending credit in smaller amounts.

While the response to the crisis was a corrective measure, the RBI regulations are a precaution in place. RBI is actively participating in drafting regulations and acting as a watchdog to such practices with the objective to develop a more robust and transparent framework to avoid a mishap like 2007-09.

While stricter regulations are becoming a challenge for the brands in adopting PPIs, they’re extensively driving consumer trust.

In the next and the last blog of the series, we will decipher the challenges and opportunities that this PPI landscape has in place for D2C brands.

Author:

Kanuj Jadwani