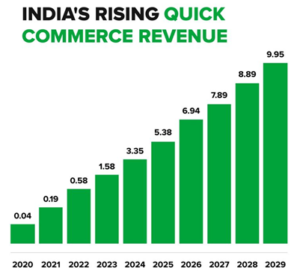

Quick commerce has achieved in just 3.5 years what took food delivery platforms an entire decade – reaching the coveted milestone of INR 250 billion in gross order value (GOV). This rise raises eyebrows and begs the question: How did this happen, and what does it mean for the future of retail?

Amount in $ Bn

The Pandemic – Catalyst

The Economics Time, Jun 23, 2020.

The COVID-19 pandemic fundamentally altered consumer behavior in ways we’re still understanding. A revealing Redseer survey found that 70% of post-pandemic consumers now prefer quick, unplanned purchases. This shift wasn’t just a temporary adjustment – it marked the beginning of an emerging megatrend that would reshape India’s retail landscape.

The potential of quick commerce hasn’t gone unnoticed by established players. Food delivery giant Zomato made headlines with its bold acquisition of Blinkit in a deal exceeding $500 million. Not to be outdone, Swiggy launched its own quick commerce venture, Instamart (originally Urban Kirana). These strategic moves underscore the sector’s perceived importance in the future of retail.

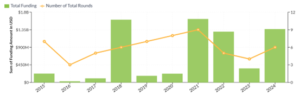

The quick commerce sector hasn’t just captured consumer attention; it’s attracted massive capital investment. Over $4 billion in funding has poured into the space, enabling companies to build sophisticated delivery networks and recruit from a pool of over 7 million gig workers. This influx of capital has fueled rapid expansion and intense competition.

However, the sector’s growth comes with a reality check – of the $4 billion invested, approximately $1 billion may have already been lost to failed ventures. Yet, despite these setbacks, quick commerce continues to grow at an astonishing rate of 230% year-over-year, outpacing food delivery by 9.6x.

Today, the market is dominated by four major players:

– Blinkit leads the pack with 45% market share

– Instamart follows with 26%

– Zepto holds 20%

– BigBasket maintains 6%

The Road Ahead:

Several indicators suggest that quick commerce still has significant room for growth:

Via Zepto’s Instagram

Further, the penetration among major CPG brands remains surprisingly low, with the top 10 established brands deriving less than 10% of their revenue from quick commerce. The sector has tapped into only about 7% of its estimated $45 billion market potential, while food delivery has achieved 24% penetration. At present, quick commerce operates at less than 50% of food delivery’s scale and value.

Reuters, Oct 21, 2024

Quick commerce stands at a fascinating crossroads. It’s a megatrend in the making, but one that hasn’t yet reached its full potential. The sector’s rapid growth and substantial investment suggest a bright future, but questions remain about sustainable profitability and market consolidation.

As we watch this space evolve, one thing is clear: quick commerce is reshaping consumer expectations and retail operations in India. Whether it can maintain its growth trajectory while achieving profitability will be one of the most interesting stories in Indian e-commerce to follow in the coming years.

The question remains: Quick Commerce is there, but is it truly there? Only time will tell…

Author

Kanuj Jadwani