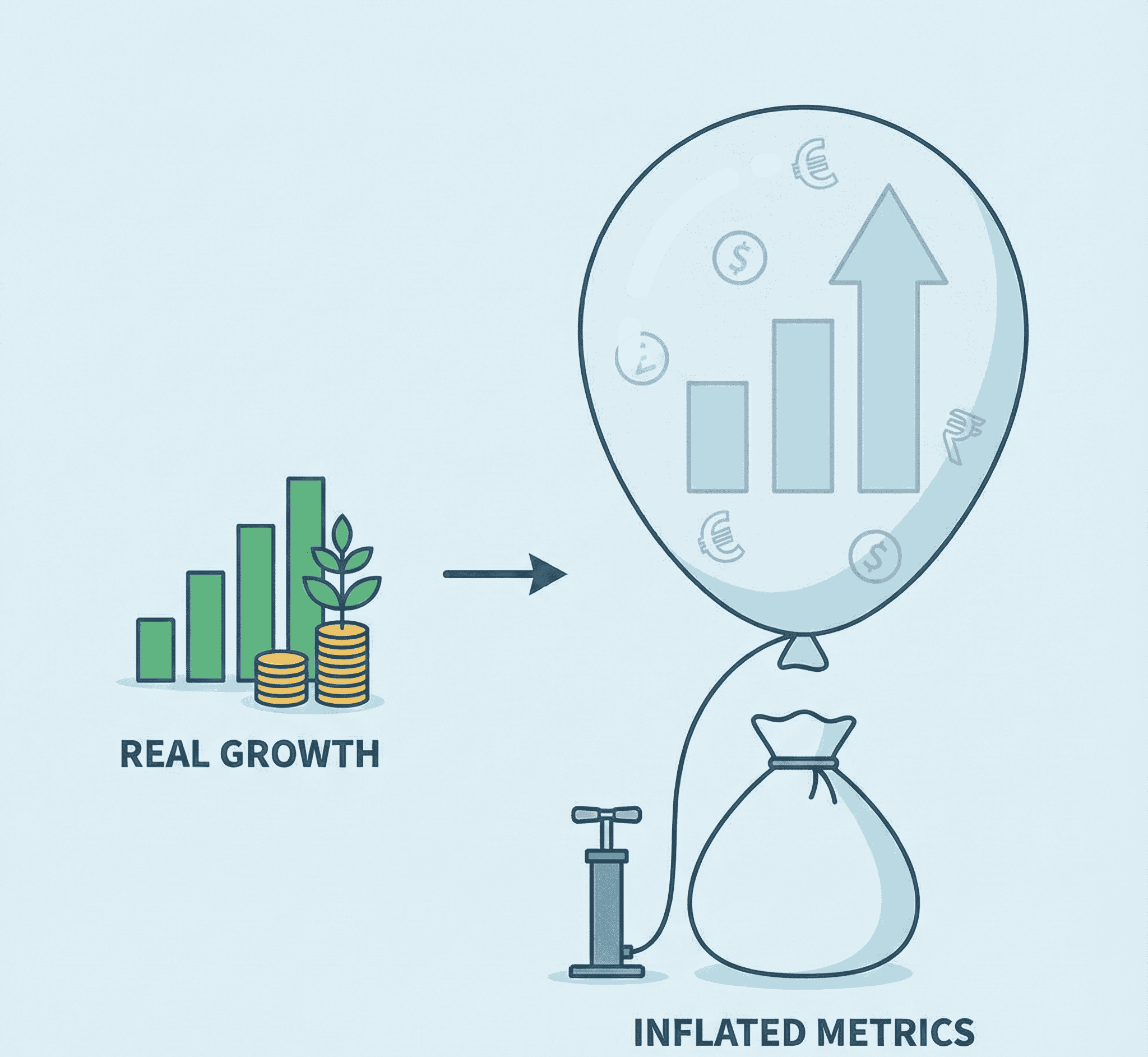

Many a times the growth strategy is displayed through ‘X’ times growth in revenues or users leading to growth in the valuations.

The representations are Excel models and made to woo the viewers aka prospective investors.

What would investors like to know!!!

Investors are interested in reviewing the numbers flow (Excel) over the period but more importantly they want to know “how do those numbers flow into the excel??”.

And the investment decision here lies on the ability of the founder to communicate the narrative behind the number story i.e. ‘The Growth Strategy’

Founders many a time while pitching the growth strategy to the investors focus too much on:

- The potential market size

- The percentage of the market they seek to capture over time

- What will they be worth after capturing it

And alongside are highlighted activities like:

- Increased social media spent

- Optimisation

- Partnerships

- Content engagement

And this is presented as the growth strategy.

But its important to note that the above are not strategies they are tactics.

Moreover, one should always remember “What got you here, will not take you there”. Thus, just increasing the social media marketing is not even a defined tactic until the expected outcome recorded with it.

E.g., The tactic to increase the reach for engagement is to target new age segment by adapting communication for the new demographics and communicating through focused network groups

Difference between Strategy and Tactics

Here’s how we define tactic vs. the strategy:

- Strategy defines long-term goals to achieve the organization’s mission.

- Tactics are much more concrete and smaller steps and a shorter time frame along the way. They involve best practices, specific plans, resources, etc.

Tactics and strategy are not at odds with one another—they are on the same team; tactics are a forming part of the strategy.

Chinese military strategist Sun Tzu wrote in The Art of War – “Strategy without tactics is the slowest route to victory. Tactics without strategy is the noise before defeat.”

Growth strategies can be identified using The Ansoff Matrix:

Market Penetration Strategy: This strategy involves selling current products or services to the existing market in order to obtain a higher market share. This strategy usually boils down Cost leadership.

Market Development Strategy: This strategy involves identifying and developing the new market segments (presently non-buying customers) for current products. This strategy usually involves heavy marketing expenses and expertise.

Product Development Strategy: This strategy involves developing new products or modifying existing products, so they appear new, and offering those products to current or new markets. A relevant example here would be Apple. Year on Year Apple upgrades existing products delivering new experience to the customers and certain times bring out innovative products like the AirPods. This strategy heavily relies on the innovation DNA.

Diversification Strategy: This strategy involves entering into a new products or product lines, new services or new markets, involving substantially different skills, technology and knowledge. This is typically a corporate strategy. E.g. Reliance Industries entering into the telecommunication space with Jio.

What makes a good strategy?

A good strategy must be ‘SMART’.

And remember,

“If you don’t have a strategy, you are part of someone else’s strategy.” — Alvin Toffler