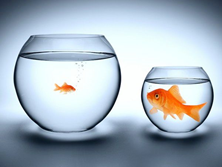

What would you rather be?? A big fish in a small pond, or a small fish in a big pond Its critical to know how you want to position yourself when facing an investor….

What would you rather be??

- A big fish in a small pond, or

- A small fish in a big pond

Many a times we hear investors ask about:

- TAM – Total Addressable Market

- SAM – Serviceable Addressable Market

- SOM – Serviceable obtainable Market

And mostly the entrepreneurs show billions of dollars of market in the above categories and they seek to maximise the size to attract investors.

The Two – Edged Sword

This approach is a two-edged sword. While a huge market indicates towards:

- Potential for tapping the users.

- Potential to generate revenues.

- Potential to experiment with the product and grow vertically and horizontally.

While the downside of a huge market in a start-up’s context is

- Increased threat of new entrant

- Low potential to dominate the market.

- Low potential to create entry barriers.

- Low potential to manage the bargaining power of the buyers and the suppliers.

- Increased competitive rivalry.

(Refer our blog: Competitive Mapping to understand deeper and analyse your business strength vis-à-vis competitor)

Second Order Thinking

A smaller fish (start-up) when in a big pond (huge markets) have ample space to swim around (experiment).

They see the vast expanse of the pond and big fishes and often dream to be as big and yet enjoy the same freedom.

But this dream is often shattered, till the time the fish (start-up) is small it enjoys the negligence of big fishes (Bigger Start-ups) but the moment the fish is big enough to be noticed, it is under threat from other bigger fishes as well as the fishermen (Govt. agencies).

Does this mean, the start-up remains small to avoid the competition and the threats????

NO!!!!

The start-up must be much more careful in a huge market while expanding. With growth it gets exponentially more challenging

- To acquire customers

- To raise funds

- To recruit talent

- And deliver Quality and price.

The cutthroat competitions lead to adverse effect on all the above.

Way Forward – Carve a niche!

Start-ups must carve their niche to scale and thrive. Carving a niche gives start-ups:

- Headroom to experiment

- Avoid Head-on competition

- Get higher investor interest.

- Ability to differentiate communication and offerings for potential customers.

- Ability to differentiate from competitors.

- Control pricing and customer expectations

- Create entry barriers and reduce threat from new entrants.

- Reduce competitive rivalry (reducing cost of customer acquisition)

This strategy can also be referred to as “Blue Ocean in Red Ocean”.

Having said so, the niche approach has some disadvantages as well:

- You have no one to learn from

- Outside the niche you’re just another small fish.

Conclusion: Grow big enough that you control your niche and then only explore entering the pond with other big fishes.

Illustration:

- Swiggy differentiates itself from Zomato by carving a niche and being a delivery only app.

- While Zomato being the oldest player in the restaurant discovery soon took head-on competition with Swiggy by introducing delivery as well.

- It took longer for Zomato to match up to the competition by Swiggy due to the niche.

- Other incumbents in the food delivery and restaurant discovery business came and went.

Author(s):

Karan Gupta

Brijesh Damodaran Nair