Investment Thesis

Our Philosophy

We believe that entrepreneurs possess a unique potential to bring about a positive change, not only for their ventures but also for the ecosystem as a whole. Our belief is simple- growth is more than just scaling businesses- it is about building a sustainable and profound impact that has the potential to reshape the ways of the ecosystem. Teaming up with the founders, we live up to our philosophy of ‘Ascending Together.’

Investment Thesis

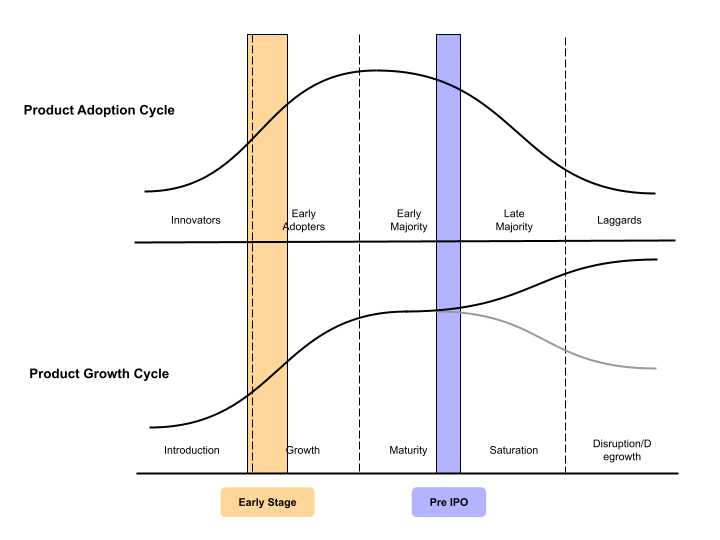

Our stage preferences are strategically positioned at the intersection of product adoption and growth cycles. Our investment approach is tailored to identifying startups that are:

- Entering the growth phase, having validated their products with early adopters, now poised for wider market acceptance.

- Transitioning into the maturity phase, where they capture the attention of the majority

Early stage: This stage typically includes seed or Series A rounds, where companies have achieved product-market fit and seek capital to start or scale operations and expand their market presence.

Exit: < 5 Years

Pre-IPO: In this stage, companies are often preparing for an initial public offering (IPO). They have a strong market presence, stable revenue, and mature operations.

Exit: ~ 2 Years

Category Distinction

Category Creator

Companies unlocking new markets through innovative solutions

Market Creator

Companies creating new consumption within an existing market

Market Leader

Established companies recognized for their market share and influence

What we look at

Product-Market Fit

The strength of the product to satisfy the needs of the market. Further validated by the market depth and acceptance of the offering.

Product-Founder Fit

The alignment of the founder’s pedigree with the offering, focusing on the unique insights and differentiated resources to deliver the product.

Founder-Market Fit

The strategy to generate value and maintain equilibrium for the stakeholders ranging from customers, suppliers, employees, investors, and regulators amongst others within the impact circle.

Path to Exit

The growth strategies to align with the fund’s exit objectives. Factors considered - Entry valuation, co-investors, traction amongst others.

Sector Pitches

We focus on technology products or technology-backed services or processes across consumer, enterprise healthcare and deep technology domains